سرویس آسانسور 1403 نگهداری ماهیانه و دوره ای آسانسور

اهمیت سرویس آسانسور در چیست؟

سرویس آسانسور شامل چیست؟

اهمیت سرویس و نگهداری آسانسور

- ایمنی

- افزایش عمر مفید

- عملکرد بهتر

- کاهش هزینه های تعمیرات

نکات مهم در سرویس و نگهداری آسانسور

نکته 1: مشکلات عملیاتی آسانسور را بررسی کنید!

نکته 2: سیستم های نمایشگرطبقات و عملکرد کلید های احضار را بررسی کنید!

نکته 3: از تمیز کننده های مناسب استفاده کنید!

نکته 4: به حداکثر وزن قابل حمل توسط آسانسور توجه کنید!

نکات مهم در سرویس آسانسور

- بررسی موتور

- بررسی تابلو فرمان

- بررسی فلکه هرزگرد

- بررسی گاورنر

- بررسی نجات اضطراری آسانسور

از سرویسکاران ماهر کمک بگیرید!

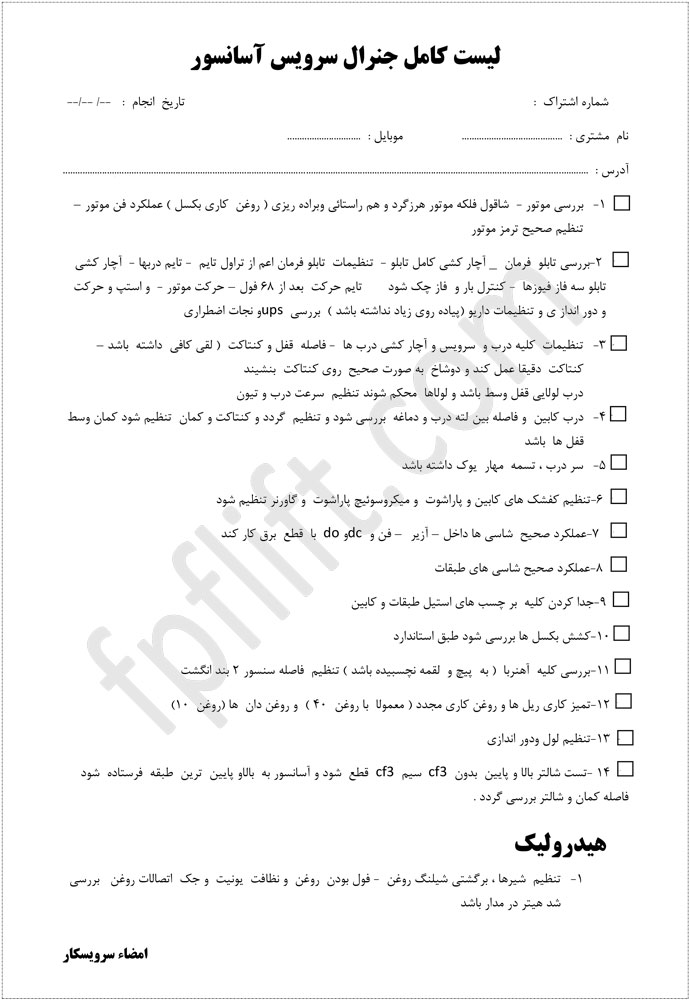

لیست کامل جنرال سرویس آسانسور

آموزش سرویس آسانسور

سرویس دوره ای آسانسور

سرویس ماهانه آسانسور

چک لیست سرویس و نگهداری آسانسور

چک لیست سرویس آسانسور شامل چیست؟

- باز و بسته شدن درب آسانسور بدون مانع یا کندی یا نقص

- بررسی دیواره های آسانسور، سقف آسانسور و کف آسانسور از نظر خرابی و ترک خوردگی

- کنترل تلفن مخصوص تماس اضطراری از داخل کابین

- بررسی سطح روغن هیدرولیکی در آسانسورهای هیدرولیک

- سرویس ترمزهای آسانسور و بررسی طناب های فولادی بالابر

- کنترل کابل های برق از نظر سالم بودن روکش ها

- بررسی تمام قطعات آسانسور از نظر وجود علائمی که عیب یا مشکل را نشان می دهند

دریافت خدمات سرویس آسانسور از بهترین شرکت

برنامه ریزی دقیق برای سرویس و نگهداری آسانسور

چک لیست سرویس آسانسور شامل چه گزینه هایی است؟

- کنترل وضعیت باز و بسته شدن صحیح درب آسانسور

- نشانه هایی از خرابی در سقف آسانسور، میله ها و دیواره ها

- وضعیت کف آسانسور

- کنترل صفحه کلید آسانسور

- بررسی سیستم روشنایی لامپ ها و چراغ های داخل کابین آسانسور

- بررسی وضعیت تماس تلفن اضطراری از داخل آسانسور با شماره های ضروری

- بررسی کابین آسانسور از نظر موقعیت قرار گرفتن در محور حرکت آن

- بررسی پانل های آسانسور از نظر فاصله استاندارد از چهارچوب

- کنترل کردن سطح روغن هیدرولیک آسانسور

- بازرسی سیستم های برق، سیم و کابل و اعلام خرابی یا نقص در صورت وجود

- بازرسی آسانسور از نظر وجود موانع برای حرکت

- کنترل صحت باز و بسته شدن دریچه خروج اضطراری در چاه آسانسور

- کنترل ترمزهای آسانسور و تایید آن از نظر عملکرد صحیح

- بررسی تمام قسمت ها از نظر ساییدگی یا خوردگی یا وجود علائمی ناشی از موجودات جونده

- بررسی حفره آسانسور در کف ساختمان از نظر ایمنی

- بررسی چهارچوب کابین آسانسور و جستجوی علائم هرگونه آسیب یا عیب

۵ نکته اصلی برای سرویس و نگهداری آسانسور

نکته 1: بررسی عملکرد آسانسور

نکته 2 :بازرسی روزانه آسانسور

نکته 3: تعویض تجهیزات معیوب و از کار افتاده

نکته 4: عدم استفاده از شوینده های صنعتی

نکته 5: حمل استاندارد بار مطابق با ظرفیت آسان

قیمت ماهانه سرویس آسانسور چقدر است؟

اگر در فکر این هستید که قیمت ماهانه سرویس آسانسور در ساختمان شما چقدر باید باشد و این یک دغدغه ذهنی برای شما است، تا پایان مطلب با ما همراه باشید؛ چرا که این بحث را به طور ویژه به این موضوع اختصاص داده ایم. در این بخش به تمام مواردی اشاره می کنیم که باید درباره هزینه تعمیرات نگهداری آسانسور بدانید. شاید تعجب کنید اما در محاسبه هزینه سرویس و نگهداری آسانسور، پرداختن به هزینه های ساختمان ضرورت دارد.

طبق آخرین گزارشات که درباره هزینه نگهداری آسانسور و قیمت سرویس ماهانه آسانسور منتشر شده، این هزینه ها بسته به نوع ارتفاع ساختمان و نوع کاربری و حجم جابجایی (ترافیک) متفاوت است. هزینه برای نگهداری و تعمیرات آسانسور، یکی از موارد مهم در هزینه های اداره یک ساختمان است . برای این که بهتر بتوانید هزینه آسانسور ساختمان خود را در هر ماه ارزیابی کنید، باید هزینه های ساختمان خود را دسته بندی کنید. راه های ساده ای وجود دارد که به شما کمک میکند هزینه تعمیرات- نگهداری آسانسور را در ساختمان خود محاسبه کنید. بر اساس اینکه تعداد توقف آسانسور شما چقدر باشد و تعداد واحد وکاربری ساختمان چگونه باشد ، قیمت سرویس ماهانه آسانسور متفاوت است.

چه عواملی بر قیمت سرویس ماهانه آسانسور تاثیر گذار هستند؟

جالب است بدانید که هزینه های تعمیرات- نگهداری و سرویس آسانسور پیچیده است، با این حال هزینهای که شما در درجه اول باید به عنوان قیمت سرویس ماهانه آسانسور پرداخت کنید، توسط چند عامل اصلی تعیین می شود. این عوامل را به ترتیب در قسمت زیر بررسی می کنیم تا شما بهتر بتوانید روی بودجه مالی خود برنامهریزی داشته باشید:

- قرارداد تعمیر و نگهداری آسانسور با شرکت مربوطه

اولین نکتهای که قیمت ماهانه سرویس و نگهداری آسانسور را تعیین میکند، نوع قراردادی است که شما در تعمیرات و نگهداری آسانسور با شرکت خدمات آسانسور امضا کرده اید. قرارداد تعمیرات و نگهداری آسانسور مشابه قرارداد بیمه نامه است. هر چه پوشش بیشتری دریافت کنید، یا تجهیزات و خدمات بیشتری در قرارداد شما نوشته شود، باید هزینه بیشتری را پرداخت کنید. به عنوان مثال، برنامه تعمیرات- نگهداری آسانسور که شامل نیروی مقیم در محل ساختمان باشد گران تر از حالتی است که فقط نیروی تکنسین شرکت آسانسور بعد از اعلام خرابی به محل اعزام شود .بنابر این نوع حضوردر محل ساختمان و نوع سرویس آسانسور در قیمت سرویس ماهانه آسانسور موثر است.

- هزینه سرویس آسانسور در شرایط اضطراری

یکی از مواردی که به شدت در قیمت تاثیر دارد این است که شما در شرایط اضطراری و اورژانسی نیاز دارید که آسانسور ساختمان، سرویس شود. وقتی آسانسور شما درست کار نکند و آن لحظه در خارج از ساعات اداری قرار داشته باشد، باید با مراکز خدمات سرویس که به صورت ۲۴ ساعته فعالیت دارند تماس بگیرید. اگر این خدمات، خارج از ساعات کاری ارائه شود، قیمت سرویس و نگهداری آسانسور گرانتر از زمانیست که در ساعات کاری قرار دارد. قبل از اینکه قرارداد سرویس و تعمیرات و نگهداری آسانسور را با شرکت امضا کنید در این باره صحبت کنید.

- نوع تجهیزات آسانسور

قیمت سرویس ماهانه آسانسور و هزینه های تعمیرات نگهداری دورهای متفاوت با جنرال سرویس وتعمیرات اساسی است. مثلاً یک آسانسور کششی نیاز به تعویض طناب های فولادی دارد؛ چیزی که اگر با مشکل مواجه شود، تعمیر آن بسیار گران تر تمام خواهد شد. در این حالت آسانسورنیاز به تعمیرات اساسی وفراتر از روال عادی سرویس آسانسور است، بنابراین می توان انتظار داشت که نوع تعمیر و سرویس در قیمت تأثیرگذار است.

- ارتفاع ساختمان و قیمت ماهانه سرویس آسانسور

عامل دیگری که تعیین کننده قیمت ماهانه سرویس و تعمیر آسانسور است، ارتفاع ساختمان شما است. هر طبقه اضافی به تجهیزات بیشتری برای نصب آسانسور نیاز دارند که این باعث میشود تعمیرات- نگهداری آسانسور حساس تر و دقیق تر باشد. ساختمان های بلندتر، سیم کشی بیشتری دارند و باید طناب فولادی بلندتری برای بالابرها نصب شود؛ بنابراین پیشبینی میشود که داشتن تجهیزات بیشتر برای یک آسانسور نیاز به زمان بیشتر برای تعویض، سرویس و نگهداری دارد که هزینه را افزایش می دهد.

- نوع کاربری ساختمان

یکی دیگر از عوامل تاثیرگذار در قیمت ماهانه سرویس در آسانسور نوع ساختمان است. تردد و استفاده از آسانسور در یک ساختمان، هزینه سرویس آسانسور را تعیین میکنند. به طور مثال، آسانسوری که هفت روز هفته از آن استفاده می شود و تعداد افراد زیادی با آن بین طبقات رفت و آمد میکنند، در معرض خرابی بیشتر قرار دارد، بنابراین باید تعمیرات - نگهداری بیشتری برای آن اجرا شود. آسانسور های داخل مجتمع های تجاری، شرکت ها و هتل ها و بیمارستان ها نمونهای از این مثال هستند. قیمت سرویس ماهانه آسانسور برای ساختمان هایی که تعداد واحد کمتر است یا ترافیک کمتری در طول هفته دارد، معمولاً ارزانتر خواهد بود. مکانی که آسانسور قرار گرفته و مدل ساختمان از نظر مجتمع های چند طبقه یا برج های مرتفع در هزینه سرویس و نگهداری آسانسور تاثیرگذار است.

مدت زمان سرویس آسانسور چقدر است؟

مدت زمان سرویس آسانسور برای انواع آسانسورهای مسکونی، تجاری و صنعتی متفاوت است. تمام آسانسورها و بالابرها نیاز به سرویس تعمیرات و نگهداری دارند. این مسئله برای ساختمان های مسکونی و تجاری اهمیت بیشتری پیدا می کند، چون در طول روز افراد زیادی از آسانسور استفاده می کنند. زمانی که برای سرویس اقدام می کنید، قطعاً بهترین تکنسین ها به محل اعزام می شوند تا خدمات کاملی را ارائه دهند. اگر صاحب یک ملک هستید، شخصاً برای تعمیرات- نگهداری و سرویس بالابر و آسانسور اقدام نکنید. اقدام هوشمندانه آن است که با شرکت خدمات آسانسور تماس بگیرید و این کار را از طریق افراد حرفهای و باتجربه پیگیری نمایید.

سرویس و نگهداری آسانسور مزایای زیادی را به همراه دارد که بزرگترین آن، افزایش ایمنی بالابر و ایمنی سرنشینان است. با توجه به مقدمه ای که عنوان کردیم باید در مدت زمان سرویس مواردی را در نظر بگیرید. مثلاً به این سوال پاسخ دهید که آسانسور شما هر چند وقت یکبار نیاز به سرویس و بازرسی دارد؟ همچنین سوال مهم است که آسانسور شما از چه نوعی است؟ موتور آن گیربکسی است یا هیدرولیکی؟ و حداکثر ظرفیت حمل بار آن چقدر است؟

پاسخ به سوالات فوق، مدت زمان سرویس آسانسور را مشخص میکند؛ همچنین به مالک ساختمان نشان میدهد که چگونه آسانسور را بررسی کند و اگر نقص یا عیبی در عملکرد آن مشاهده کرد، با شرکت آسانسور تماس بگیرد. هر چه بیشتر از آسانسور مراقبت کنید، هزینه های تعمیرات و نگهداری و تعویض قطعات در آینده برای شما کمتر خواهد شد. با سرویس و نگهداری آسانسور از هزینه های غیرضروری جلوگیری می کنید.

مدت زمان سرویس به صورت دوره ای

در حالی که عوامل متعددی در چگونگی انجام تعمیرات و نگهداری آسانسور نقش دارند، تخمین مدت زمان سرویس آسانسور دقیقاً به شرایطی بستگی دارد که تکنسین آسانسور از تاسیسات بازدید می کند. به طور استاندارد و متداول، مدت زمان برای سرویس انواع آسانسور یا بازرسی و تعمیرات- نگهداری، حدود ۱۲ ماه است. برخی از انواع آسانسور در مدلهای محدود وجود دارند که برای تعمیرات و نگهداری و سرویس آنها هر چند سال یک بار باید اقدام کرد. برخی از انواع آسانسور نیز پس از چند سال حتماً نیاز دارند که قطعات آن تعویض شود یا با مدلهای جدید جایگزین گردد. با این حال اگر مشاهده می کنید که آسانسور شما با کوچکترین عیب یا نقصی مواجه شده باید با شرکت خدمات آسانسور تماس بگیرید تا سریع تر این تاسیسات را بازرسی کنند.

قرارداد تعمیرات و نگهداری آسانسور

شرکتی که شما برای خدمات سرویس آسانسور، تعمیرات و نگهداری آسانسور انتخاب می کنید، هنگام ارائه این خدمات یک قرارداد به شما ارائه می دهد. در متن قرارداد ویژگی های مختلفی عنوان شده است. سعی کنید وقتی می خواهید قرارداد سرویس و تعمیرات و نگهداری آسانسور را در بازه زمانی 1 ساله تنظیم کنید، به نیازهای ساختمان، میزان تردد با آسانسور، احتمال خرابی آسانسور، مدل آسانسور و بودجه مالی خود دقت داشته باشید. نوع کاربری آسانسور مشخص می کند که مدت زمان سرویس باید چند ماه باشد. این موارد از سوی شرکت به شما اعلام می شود.

مدت زمان سرویس در آسانسور به چه عواملی بستگی دارد؟

یکی از فاکتورهایی که در مدت زمان سرویس آسانسور نقش دارد، موقعیت ساختمان است. موقعیت محل نشان می دهد که شما چند دفعه به نگهداری و تعمیرات آسانسور نیاز دارید. هر آسانسور در هر ساختمان در هر شهر که نصب شده باشد به طور منظم باید بازرسی و نگهداری شود تا از بروز حوادث پیش بینی نشده جلوگیری گردد. نصب انواع آسانسور در شهرهای مختلف به شیوه های متفاوت انجام می گیرد، اما همه آنها از یک استاندارد تبعیت می کنند.

هزینه سرویس و نگهدری آسانسور باز هم در شهرهای مختلف و مناطق متفاوت با هم فرق دارد. ممکن است در یک شهر یا منطقه، هزینه تعمیرات نگهداری آسانسور بسیار ارزان باشند. همچنین هزینه برای آسانسورهای ساده و مسکونی قیمت کمتری دارد. تعمیرات- نگهداری آسانسورهای لاکچری یا آسانسورهای برج های چند طبقه و برج های بلند و مرتفع، هزینه بیشتری به دنبال خواهد داشت. از آنجایی که آسانسور یک وسیله کاربردی و اجتناب ناپذیر برای ساختمان های چند طبقه است، تعمیرات، سرویس و نگهداری آنها جزو ضروریات محسوب می شود. اختصاص هزینه برای سرویس در آسانسور نوعی سرمایهگذاری است که ساختمان را در برابر هزینه های هنگفت و حوادث جبران ناپذیر حفظ می کند.

اگر به مدت زمان سرویس آسانسور در ساختمان خود توجه ویژه داشته باشید، از بروز حادثه ها جلوگیری می کنید. آسانسورهای مسکونی، تجاری، آسانسورها در ساختمان های هتل و آسانسورهای صنعتی، همه به این خدمات نیاز دارند. بازرسی و نگهداری مداوم و پیوسته برای انواع آسانسور طبق استانداردها انجام میشود. فراموش نکنید که این خدمات حتماً باید توسط تکنسین های با تجربه و با سابقه کاری معتبر ارائه گردند.

چرا سرویس و تعمیرات دورهای آسانسور ضروری است؟

اگر سرویس و نگهداری دوره ای آسانسور به موقع انجام شود، میزان خرابی قطعات آسانسور کاهش پیدا می کند و این موضوع ارتباط مستقیم با کاهش هزینه و افزایش طول عمر آسانسور دارد. سرویس آسانسور اصفهان و نگهداری آسانسور در ساختمان های مختلف، متفاوت است. به طور مثال در ساختمان های تجاری و اداری، از آسانسور به صورت مداوم استفاده می شود و کابین آسانسور به طور مداوم در حرکت است که این امر، بی تاثیر در ساییدگی درب آسانسور نیست. بدین ترتیب، تکنسین مربوطه به منظور حفظ ایمنی و پیشگیری از فرسودگی آسانسور، برنامه زمانی کوتاه تری را برای سرویس و نگهداری در نظر میگیرد. عوامل مختلفی تعیین کننده زمان نگهداری و سرویس شامل موارد زیر است که درباره هر یک، توضیح مختصری ارائه می شود.

- انواع مدل آسانسور

آسانسور دارای انواع مختلفی است. انتخاب نوع آسانسور، بسته به نوع استفاده متفاوت است، بنابراین زمان سرویس و نگهداری هر یک، متفاوت از دیگری در نظر گرفته می شود. شرکتی که آسانسور را ارائه می دهد در ارتباط با بازرسی و سرویس ، شما را راهنمایی می کند و اطلاعات لازم را در اختیارتان قرار خواهد داد.

- محل زندگی

در هر شهر، هزینه های مربوط به بازرسی و نگهداری آسانسور و مقررات ایمنی تعیین شده برای مراقبت از آسانسور ممکن است متفاوت باشد؛ بنابراین پیروی از قوانین مربوط به سرویس و نگهداری آسانسور در هر شهری حائز اهمیت است. سرویس آسانسور اصفهان در شرایط اضطراری توسط افراد حرفه ای اجرا می شود تا با حداقل هزینه، هر چه سریع تر آسانسور به حالت قبلی خود باز گردانده شود و ایمنی ساختمان حفظ گردد.

- نوع قرارداد منعقد شده

انتخاب نوع پیمانکار، در هنگام نصب اسانسور این امکان را برایتان فراهم می کند که زمان سرویس و نگهداری آسانسور مشخص شود و به نیازهای شما به بهترین شکل ممکن پاسخ داده شود.

تعرفه سرویس و نگهداری آسانسور 1403

تعرفه سرویس آسانسور 1403 بر اساس نوع ساختمان

- ساختمان های گروه ۱ شامل ساختمان های مسکونی است.

- ساختمان های گروه ۲ شامل ساختمان های اداری تا ۱۰ واحد است.

- ساختمان های گروه ۳ شامل ساختمان های اداری از ۱۰ واحد به بالا، مجتمع های تجاری، ساختمان پزشکی، بانک ها، مدارس، مجتمع های تفریحی، رستوران ها و تالارهای پذیرایی، آسانسورهای پارکینگ های عمومی و مسافرخانه ها است.

- ساختمان های گروه ۴ شامل بیمارستان ها، درمانگاه ها، مراکز خدمات درمانی، آزمایشگاه، رادیولوژی، هتل ها و آشپزخانه های صنعتی است.

- ساختمان های گروه ۵ شامل سازمان های بزرگ دولتی و عمومی، دادسراها و دادگاه ها، شهرداری، کلانتری، وزارتخانه، فرودگاه، مترو، مسجد و نظایر اینها است.

نکات مهم در محاسبه تعرفه سرویس آسانسور 1403

- سرویس بر اساس قرارداد معتبر با شرکت آسانسور انجام می گیرد. در این قرارداد، تعرفه سرویس و تعمیرات آسانسور 1403 طبق جدول مصوب درج می شود.

- هزینه های تعمیرات و نگهداری و سرویس برای ساختمان هایی که در بافت شهری قرار دارند، یا ساختمانهایی که در حومه شهر قرار دارند، متفاوت است. هر گونه افزایش قیمت باید با اطلاع شرکت آسانسور انجام گیرد.

- تعرفه سرویس آسانسور 1403 به طور متداول برای آسانسورهایی ارائه شده است که با سرعت یک متر بر ثانیه حرکت می کنند. اگر سرعت آسانسور از این مقدار متوسط، افزایش داشته باشد، تعرفه های سرویس یا تعمیرات- نگهداری، مشمول درصدی افزایش خواهد بود. این افزایش قیمت با توافق طرفین است.

- هزینه هایی که برای دستمزد نصاب و تکنسین ها جهت تعمیرات و نگهداری آسانسور لحاظ می شود، در نرخنامه مصوب سندیکا نیامده است؛ بنابراین بر اساس شیفت کاری و توافق طرفین و صلاحدید شرکت آسانسور این دستمزد تعیین می گردد.

- تعرفه سرویس 1403 برای آسانسورهایی که درب آن ها به صورت دو طرفه باز و بسته می شود یا آسانسورهایی که ارتفاع درب آنها از حد متعادل بیشتر است، جزو مصوب سندیکا نیست و با توافق طرفین افزایش پیدا می کند.

- تعرفه سرویس و نگهداری آسانسور 1403 برای آسانسورهای صنعتی، آسانسور هیدرولیکی یا انواع بالابرها یا آسانسورهایی که از حالت متعادل تعریف شده در جدول سندیکا، خارج هستند، با صلاحدید شرکت آسانسور تعیین می شود.

در سرویس آسانسور چه قطعاتی باید تعویض گردند؟

بازرسی سرویس و تعمیرات آسانسور چگونه انجام می شود؟

- ارتباط با مستاجراین :

به مستاجران اطلاع دهید که تعمیر و نگهداری برنامه ریزی شده در حال انجام است ، تا آن ها از علائم و تذکرات پیروی کنند. از رفت و آمد زیاد خودداری کنید و همیشه مطمئن شوید که آسانسور یا پله جایگزین در دسترس است. در تمام طبقات کلیدی که آسانسور در آن متوقف می شود ، تابلو راهنما قرار دهید.

- انجام بازرسی :

انجام ممیزی تجهیزات آسانسور به تعیین وضعیت تجهیزات ، انواع تعمیرات لازم و سایر خدمات مورد نیاز کمک می کند. برای اطمینان از ایمنی آسانسور ، قسمت های زیر را بررسی کنید :

- داخل کابین :

وضعیت علائم و نشانه های عملکرد دستگاه ، عملکرد دکمه ها، تهویه ، روشنایی ، نیروی درب کابین هنگام باز و بسته شدن را بررسی کنید. اطمینان حاصل کنید که دستگاه های اضطراری در دسترس هستند و در شرایط کار خوب قرار دارند.

- قسمت بالای کابین :

بررسی کنید که آیا کابل های مسافرتی و بالابرها عملکردی دارند و به درستی تنظیم شده اند. روغن کاری مناسب برای ریل ها ، طناب های گاورنر ، وسایل تعلیق ، زنجیرها و غیره را اعمال کنید.

- بازرسی اتاق ماشین :

ارزیابی شرایط تجهیزات در اتاق ماشین بسیار مهم است. روغنکاری مورد نیاز را برای وسایل تعلیق ، چرخ دنده ها، یاطاقان و سایر تجهیزات مکانیکی که نیاز به روانکاری دارند ، تامین کنید.

- تهیه گزارش :

یک گزارش جامع از بازرسی شامل عکس های هر گونه نقص تجهیزات و شرح هر گونه مشکل عملیاتی را تکمیل کنید. گزارشات مستند برای رعایت مقررات ، الزامات ایمنی آتش سوزی و گزارش های نگهداری مورد نیاز است.

وظایف سرویس کار آسانسور چیست؟

صفر تا صد وظایف سرویس کار آسانسور

انواع خدمات سرویس و نگهداری آسانسور

- بازرسی:

بازرسی در مقاطع زمانی مشخص از آسانسور صورت می گیرد تا مشخص شود که آیا قطعات نیاز به تنظیم و سرویس دارند یا خیر و در صورت وجود اشکال ، تعمیرات پیشگیرانه در زمان درست انجام شود.

- سرویس:

هنگامی که در طی بازرسی نیاز به سرویس احساس شود برای قسمت های متحرک و ثابت اعم از الکتریکی و مکانیکی سرویس دهی انجام می گیرد. هر آسانسور باید دارای چک لیست سرویس و نگهداری آسانسور باشد تا ماهیانه حداقل یک بار مورد بررسی قرار گیرد.

- تعمیر پیشگیرانه:

تعمیرات پیشگیرانه زمانی انجام میشود که هنوز امکانات وسایل نسبی در حال کار است و دچار خرابی نشده اما تعمیرات پیشگیرانه باعث میشود که خرابی سیستم به تعویق افتاده یا جلوی خرابی های آتی گرفته شود.

- تعمیرات رفع خرابی :

هنگامی که دستگاه از کار افتاده باشد و نتواند وظایف تعیین شده را انجام دهد لازم است تعمیرات رفع خرابی انجام شود و آسانسور مجدداً راه اندازی و مورد بهره برداری قرار گیرد.

مزایای سرویس و نگهداری آسانسور

- افزایش کارایی و بهره وری

- تاثیر سرویس و نگهداری آسانسور در کاهش هزینه ها

- برقراری امنیت و حفظ جان سرنشینان

مراحل و اقدامات سرویس آسانسور

- طبق برنامه ای منظم و سیستماتیک باید روغن کاری و تنظیم آسانسور انجام شود

- در بازرسی های منظم باید قطعات فرسوده تعویض و درصورت لزوم قطعات سالم وقابل استفاده تنظیم یا تعمیر شود

- آزمایشات ایمنی دوره ای مشخص شده طبق چک لیست های بازرسی انجام شود.

شرکت آسانسور فعال ارائه دهنده سرویس آسانسور در اصفهان است.

ارسال نظر

نکته: HTML ترجمه نمی شود!