ایران، علاوه بر ارائه برندهای معتبر جهانی موتور آسانسور، موتورهای باکیفیت و متناسبی را با موفقیت تولید کرده است. این موتورها در مقایسه با نمونه های مشابه خارجی، قیمت رقابتی دارند. از برندهای معتبر ایرانی می توان به موتور آسانسور بهران، Kopel IR10 و IR20، WSR، فرشباف و الکو اشاره کرد. برخی از موتورهای آسانسور ایرانی ممکن است دارای قطعات وارداتی خاصی باشند، اما مونتاژ آنها در داخل ایران انجام می شود. بیایید هر برند را به صورت جداگانه بررسی کنیم:

بهران، شرکت پیشگام و مبتکر ایرانی در صنعت آسانسور است که موتورهای مخصوص بازار ایران را طراحی و تولید انبوه می کند. یکی از ویژگی های بارز موتورهای بهران، حرکت نرم آنها بدون لرزش و ضربه می باشد. این ویژگی، منجر به کاهش صدای آسانسور می شود. موتورهای بهران باعث بهره وری انرژی شده و مصرف انرژی و برق را به میزان قابل توجهی کاهش می دهند.

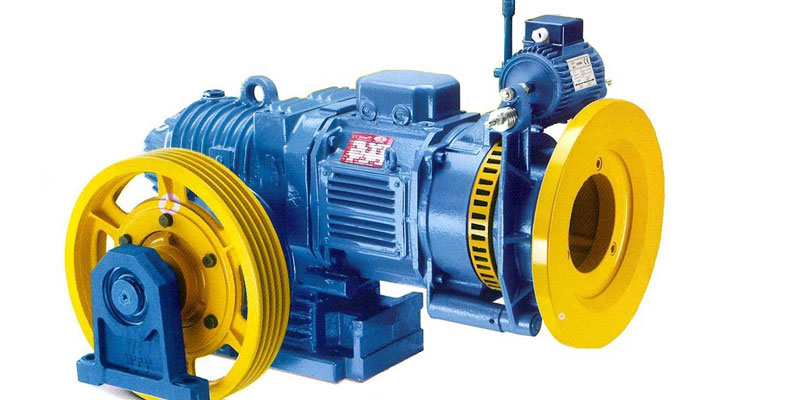

شرکت آسانسور کوپل که در سال 1370 تاسیس شد، در همان سال با خرید نمایندگی شرکت سیکور، فعالیت خود را گسترش داد. در سال 1373، کوپل با شرکت ویتور همکاری کرد و از وزارت صنایع برای ساخت موتور آسانسور، موتور گیربکس، درب اتوماتیک و غیره مجوز گرفت. موتور آسانسور IR10 و IR20 به عنوان محصول مشترک شرکت ایرانی کوپل و شرکت پریمو هند تولید شده اند. این موتورها به صورت SKD از هند وارد می شوند. آنها بر اساس تکنولوژی PRIMO ایتالیا طراحی و مهندسی شده و در ایران مونتاژ می گردند. این نوع موتورها به عنوان یکی از بهترین موتورهای آسانسور تولید شده در ایران شناخته می شوند. موتور آسانسور Kopel IR10 با عملکرد استثنایی گیربکس، به لطف قیمت مناسب خود، با موتورهای خارجی رقابت می کند. هر دو موتور Kouple IR10 و Kouple IR20 در هند تولید می شوند و طراحی و فناوری PRIMO ایتالیا را در خود جای داده اند. این موتورها، سپس در ایران مونتاژ می شوند تا بالاترین استانداردهای کیفیت را تضمین کنند.

گروه صنعتی فرشباف، طراحی و تولید موتور آسانسور فرشباف در ایران را بر عهده دارد. این موتورها از مدل های معروف ایتالیایی مانند Sassi، Secor و Ital Gears الهام گرفته اند. قیمت پایین تر موتور فرشباف به نسبت سایر برندهای ایرانی باعث شده که در داخل کشور مورد توجه قرار گیرد. تولید و مونتاژ این موتورها به طور کامل در ایران انجام می شود؛ اما طراحی آنها از سازندگان ایتالیایی مانند ساسی و ایتال الهام گرفته شده است.

موتور WEBER یک موتور گیرلس تولید داخلی پیشگام است. این موتور گیرلس، مزایای قیمتی قابل توجهی را نسبت به موتورهای گیربکس و سایر موتورهای گیرلس ارائه می دهد. تولید انبوه موتور WEBER در سال 1397 توسط شرکت پاک صنعت موتور، با ظرفیت سالانه 5000 دستگاه شروع شد. وبر با به دست آوردن نشان CE به رسمیت شناخته شده و استانداردهای ایمنی اروپا را رعایت می کند. اگر به دنبال موتور آسانسوری با قیمت اقتصادی و کیفیت بالا هستید، موتورهای WEBER را به عنوان یک انتخاب در نظر بگیرید.

موتورهای آسانسور خارجی

باکیفیت ترین و بهترین موتورهای خارجی موجود در بازار عبارتند از:

موتور آسانسور زیلابگ ساخت کشور آلمان، در حال حاضر یکی از برترین موتورهای گیرلس وارداتی کشور محسوب می شود. این موتورها با رعایت کامل استانداردهای بین المللی در آلمان طراحی و تولید می شوند. از این رو، قیمت بالاتری نسبت به سایر برندها دارند. یکی از ویژگی های کلیدی که موتورهای Zillabag آلمان را متمایز می کند، درایو و اینورتر تخصصی می باشد. درایو و اینورتر این موتور آسانسور، کاملا توسط شرکت Zillabag توسعه و تولید شده است. این اینورترها منحصرا برای کاربردهای صنعت آسانسور طراحی می شوند. هماهنگی موجود در این موتور، منجر به حرکت آسان و راحت آسانسور می شود. مونتاژ ترمز موتور زیلابگ، نیاز به ابزار خاصی برای تعمیر یا تعویض دارد.

موتور آسانسور آلبرتوساسی که منشا آن ایتالیا است، با نام های جایگزین مانند موتور ایتالیایی ساسی نیز شناخته می شود. این موتور، کیفیت استثنایی دارد. به همین علت، در بین نصاب ها و شرکت های نصب آسانسور محبوبیت زیادی پیدا کرده است. موتور آلبرتوساسی که به طور گسترده به عنوان معتبرترین برند آسانسور شناخته می شود، در بازار ایران و بین الملل، حضور چشمگیری دارد. این موتور با سابقه حضور حدود 20 سال، دارای فروش سالانه زیادی در بازار ایران است.

- موتور آسانسور هوبر ایتالیا

ایتالیا خود را به عنوان پیشرو در تولید موتورهای آسانسور تثبیت کرده است. یکی از برندهای تولیدکننده موتور آسانسور ایتالیایی، Huber بوده که از سال 2014 فعالیت خود را آغاز کرد. موتورهای آسانسور هوبر با تمرکز بر ارائه کیفیت استثنایی، دارای مزایایی همچون موارد زیر هستند:

- حرکت روان

- حداقل لرزش

- مصرف بهینه انرژی

- عدم نیاز به موتورخانه جداگانه

آرکل که یک شرکت ترکیه ای است، فعالیت خود را در سال 1998 در صنعت موتور آسانسور شروع کرد. آنها موتور آسانسور اولیه خود را بین سال های 2005 تا 2006 طراحی و تولید و با موفقیت وارد بازار کردند. امروزه، آرکل موتورهای آسانسور درجه یک خود را به کشورهای مختلف در سراسر خاورمیانه، آفریقا، اروپا، آسیا و حتی استرالیا صادر می کند.

- موتور آسانسور مونتاناری ایتالیا

یکی از برندهای معروف موتور آسانسور ایتالیا، مونتاناری است. مونتاناری که در سال 1970 تاسیس شده، در تولید و صادرات موتورهای گیربکس، سیستم های گیربکس و سایر تجهیزات آسانسور تخصص دارد. این شرکت با نمونه های صنعتی مشابه رقابت می کند. همچنین، در بازار ایران به عنوان یکی از قدیمی ترین و مورد اعتماد ترین تولید کنندگان موتور گیربکس آسانسور شناخته شده است. مدل های قابل توجه موتورهای گیربکس مونتاناری عبارتند از: M75s، M73s و M76s. هر کدام از این مدل ها، توان و ظرفیت متفاوتی را ارائه می دهد. تعهد مونتاناری به استانداردهای کیفی بین المللی، شهرت آنها را بیشتر می کند.

موتور آسانسور Secor ساخت ایتالیا بوده و به عنوان یکی از برندهای برتر در صنعت موتور آسانسور در سطح جهانی شناخته شده است. این موتور، در بازار ایران با نام موتور الکمپ شناخته می شود. این موتورها به دلیل قیمت مناسب و کیفیت مطمئن، مورد توجه پیمانکاران و شرکت های نصب آسانسور قرار گرفته اند. هنگام خرید موتورهای سیکور، اطمینان از اصالت محصول، بسیار مهم است.

یکی دیگر از موتورهای آسانسور ساخت ایتالیا، به نام موتور ایتال نیز در بازار موجود است. این موتور، در مقایسه با سایر موتورهای ایتالیایی، قیمت مناسب تری را ارائه می دهد. موتورهای گیربکس ایتال در ظرفیت های مختلف (5.5 کیلو وات، 6.1 گیگاوات و 7.3 کیلووات) و در دو نوع بلبرینگی و یاتاقانی عرضه می شوند. این موتورها محبوبیت قابل توجهی پیدا کرده اند و در سال های اخیر جزو پرفروش ترین گزینه ها بوده اند. مانند موتور سیکور ایتالیا، ایتال موتور از بالاترین استانداردهای کیفی پیروی می کند. این برند، اقدامات کنترلی دقیقی را مطابق با استاندارد جهانی EN81 انجام می دهد. موتور این برند در مقایسه با سایر موتورهای ساخت ایتالیا، به عنوان یک محصول با قیمتی رقابتی و استانداردها و کیفیت استثنایی شناخته می شود.

برند فیا، یک تولید کننده مشهور ایتالیایی بوده و دارای شهرتی است که به ندرت در بازار رقابتی ایران شاهد آن هستیم. کل مراحل تولید قطعات موتورهای آسانسور فیا، از پردازش تا تولید نهایی، منحصرا در ایتالیا انجام می شوند. هر موتور ساخته شده توسط شرکت فیا، مطابق با استانداردهای بین المللی و دارای گواهینامه هایی مانند استاندارد اروپایی EN81 است.

از کجا موتور آسانسور بخریم؟

اگر به دنبال خرید موتور آسانسور هستید، مطمئنا می توانید باکیفیت ترین موتورهای آسانسور را از شرکت ما خریداری کنید. در شرکت آسانسور فعال، ما با مهندسان و تامین کنندگان قابل اعتمادی همکاری می کنیم. بدین صورت، موتورهای آسانسور با کیفیت بالایی را به مشتریان خود ارائه می دهیم. موتورهای ارائه شده توسط تیم مهندسین ما با استانداردها و مشخصات صنعتی مطابقت دارند.

برای خرید لطفا به قسمت محصولات وب سایت ما مراجعه کنید. در آنجا اطلاعات دقیقی در مورد موتورهای آسانسور، از جمله مشخصات، قیمت و هر گونه خدماتی که ارائه می دهیم را خواهید یافت. سایت ما به گونه ای طراحی شده که به شما امکان می دهد تا به راحتی در میان گزینه ها، پیمایش نمایید و خرید کنید. علاوه بر این، تیم پشتیبانی ما برای کمک به شما درباره هرگونه سؤال یا نگرانی در مورد موتورهای آسانسور یا فرآیند خرید در دسترس است. شما می توانید از طریق صفحه تماس وب سایت ما یا تماس با خط تلفن پشتیبانی مشتری، با ما تماس بگیرید.

شاخص های کیفیت موتور آسانسور

ایمنی و عملکرد روان آسانسور، به شدت به کیفیت و قابلیت اطمینان موتور آن بستگی دارد. موتور آسانسور به عنوان نیروگاه عمل می کند و مسئول حرکت عمودی کابین آسانسور و مسافران داخل آن است. برای اطمینان از کیفیت بالای موتور آسانسور و رعایت استانداردهای لازم، باید شاخص های کلیدی خاصی را ارزیابی کنید. برای اینکه مطمئن شوید که موتور در شرایط خوب و عملکرد بهینه است، شاخص های زیر را در نظر بگیرید:

توان خروجی موتور آسانسور، یک شاخص اساسی برای عملکرد آن است. توان خروجی، به توانایی موتور برای تولید نیروی کافی جهت حرکت روان کابین آسانسور، مسافران و سایر بارهای اضافی، اشاره دارد. خروجی های توان بالاتر عموما مطلوب هستند؛ زیرا عملکرد و ایمنی بهتری را ارائه می دهند. با این حال، برای اطمینان از عملکرد کارآمد باید توان خروجی را با الزامات خاص آسانسور، تطبیق دهید.

بازده موتور، اندازه گیری می کند که موتور چقدر انرژی الکتریکی را به کار مکانیکی تبدیل می نماید. معمولا راندمان، به صورت درصد بیان می شود. رتبه بازده بالاتر، موتوری را نشان می دهد که حداقل اتلاف انرژی را دارد. در نتیجه عملکرد بهتری داشته و باعث کاهش مصرف انرژی می شود. بررسی رتبه بازده موتور برای ارزیابی قابلیت صرفه جویی در انرژی و کیفیت کلی آن، مهم است.

گشتاور راه اندازی، توانایی موتور برای راه اندازی هموار کابین آسانسور از یک موقعیت ثابت را اندازه گیری می کند. یک موتور قوی باید دارای گشتاور راه اندازی کافی برای غلبه بر اینرسی و شروع حرکت بدون هیچ تکان یا حرکت ناگهانی باشد. گشتاور کم استارت می تواند منجر به نقص آسانسور، تاخیر و ناراحتی مسافران شود.

صدای موتور و ارتعاشات می توانند به طور قابل توجهی بر راحتی و ایمنی مسافران تأثیر بگذارند. موتور آسانسور با کیفیت بالا طوری طراحی شده که بی سر و صدا و با حداقل لرزش کار کند. سر و صدای زیاد یا ارتعاشات می توانند نشان دهنده شل شدن قطعات، سایش یاتاقان یا سایر مشکلات مکانیکی باشند. این مشکلات، در نهایت منجر به خرابی موتور می شوند. اطمینان یافتن از اینکه موتور بدون نویز و لرزش کار می کند، برای تجربه خوشایند مسافر و طول عمر کلی موتور، بسیار مهم است.

طول عمر موتور آسانسور، نشان دهنده دوام و قابلیت اطمینان موتور در طول زمان است. عواملی مانند کیفیت ساخت، نگهداری و شرایط عملیاتی به طول عمر موتور کمک می کنند. بازرسی و نگهداری منظم، طبق توصیه های سازنده می تواند به افزایش عمر موتور و جلوگیری از خرابی های زودرس کمک کند.

موتورهای آسانسور در حین کار، تمایل به تولید گرما دارند. مکانیسم های مناسب حفاظت از گرمای بیش از حد برای جلوگیری از آسیب موتور و اطمینان از عملکرد ایمن، بسیار مهم هستند. موتورهای باکیفیت، دارای تجهیزات حفاظت حرارتی می باشند که در صورت رسیدن به دمای بحرانی، موتور را به طور خودکار خاموش می کنند. بررسی حفاظت حرارتی موتور، برای جلوگیری از حوادث و اطمینان از طول عمر موتور، ضروری است.

- تعمیر و نگهداری و قابلیت سرویس دهی

تعمیر و نگهداری آسان و قابلیت سرویس، فاکتورهای مهمی هستند که هنگام ارزیابی کیفیت موتور آسانسور باید در نظر گرفته شوند. قطعاتی مانند برس ها، یاتاقان ها و نقاط روغن کاری باید به راحتی برای انجام کارهای بازرسی و تعمیر و نگهداری معمول در دسترس باشند. دفترچه راهنمای خدمات و در دسترس بودن قطعات یدکی، به دوام طولانی مدت موتور کمک می کنند.

شاخص های کیفیتی که در بالا مورد بحث قرار گرفتند، باید در هنگام ارزیابی عملکرد و ایمنی موتور آسانسور در نظر گرفته شوند. با بررسی این شاخص ها، می توانید اطلاعاتی درباره توان خروجی، راندمان، گشتاور راه اندازی، سطوح نویز، طول عمر و قابلیت سرویس به دست آورید. با بازرسی های منظم، تعمیر و نگهداری و مشاوره با متخصصان می توانید مطمئن شوید که موتور آسانسور، استانداردهای کیفی لازم را دارد. در نهایت، این کار منجر به عملکرد ایمن و قابل اعتماد آسانسور برای مسافران می شود.

.jpg)

شاخص های قیمت موتور آسانسور

موتور آسانسور جزء حیاتی هر سیستم آسانسوری است که وظیفه حمل و نقل در داخل ساختمان را بر عهده دارد. عملکرد، کارایی و ایمنی موتور، به عنوان قلب آسانسور، نقش کلیدی در تعیین قیمت کلی ایفا می کند. عواملی که بر قیمت موتورهای آسانسور تأثیر می گذارند، عبارتند از:

یکی از عوامل اصلی موثر بر قیمت موتور آسانسور، توان و ظرفیت آن است. توان موتور به طور مستقیم با توانایی آن در جابجایی بارهای سنگین و حمل سریع و ایمن مسافران مرتبط می باشد. موتورهای با ظرفیت بالاتر با اسب بخار بیشتر، قادر به بلند کردن وزنه های بار بزرگتر هستند. این موتورها، امکان کار کردن آسانسورها را در ساختمان های بلندتر فراهم می کنند. در نتیجه، موتورهای با توان و ظرفیت بالاتر در مقایسه با آسانسورهای دارای ظرفیت کمتر، گران تر هستند.

سیستم کنترل موتور آسانسور نیز به میزان قابل توجهی بر قیمت آن تاثیر می گذارد. یک سیستم کنترل پیچیده، عملکرد روان و کارآمد آسانسور را تضمین می کند. همچنین، امکان انتخاب دقیق طبقه، کنترل سرعت و ویژگی های ایمنی پیشرفته را فراهم می آورد. موتورهای مجهز به سیستم های کنترل پیشرفته مبتنی بر ریزپردازنده یا درایوهای ولتاژ و فرکانس متغیر هوشمند، به دلیل پیچیدگی و کارکردشان، هزینه بیشتری دارند.

تکنولوژی پیشرفته، نقش حیاتی در تعیین قیمت موتور آسانسور دارد. موتورهای مدرن تر و کم مصرف تر اغلب به گونه ای طراحی می شوند که انرژی کمتری مصرف کنند. در عین حال عملکردی مشابه یا حتی بهتر نسبت به موتورهای سنتی و پرمصرف دارند. موتورهایی که دارای فناوری هایی مانند درایوهای ریجنراتوری(احیاکننده انرژی ) ، درایوهای فرکانس متغیر (VFD) یا موتورهای آهنربای دائمی هستند، کارآمدتر در نظر گرفته می شوند. این موتورها در طولانی مدت باعث صرفه جویی در انرژی خواهند شد. با این حال، چنین فناوری های پیشرفته ای، قیمت بالاتری دارند.

ایمنی و کیفیت موتور آسانسور در هنگام تعیین قیمت آن، عوامل بسیار مهمی هستند. موتورهای ساخته شده با مواد باکیفیت، طراحی مستحکم و طول عمر بیشتری دارند و به تعمیر و نگهداری کمتری نیاز پیدا می کنند. این عوامل، هزینه های کلی تعمیر و نگهداری آسانسور را کاهش می دهند. در نتیجه، موتورهای آسانسور با ایمنی و کیفیت بهتر، به دلیل افزایش سرمایه گذاری در ساخت و طراحی، قیمت بالاتری دارند.

موتورهای آسانسور برای اطمینان از رفاه مسافران و مطابقت با مقررات محلی، باید استانداردهای ایمنی دقیق را رعایت کنند. آنها برای مطابقت با کدها و مقررات ایمنی، مانند EN 81 و ASME A17.1، نیاز به طراحی، آزمایش و فرآیندهای صدور گواهینامه اضافی دارند. هزینه های مربوط به مطابقت با استانداردهای ایمنی می توانند بر قیمت کلی موتور آسانسور تأثیر بگذارند. خریداران باید موتورهایی را که الزامات ایمنی را برآورده می کنند، برای تضمین ایمنی سیستم های آسانسور خود انتخاب کنند.

.jpg)

اجزا و قطعات موتور آسانسور

اجزا و قطعات مختلف تشکیل دهنده موتور آسانسور عبارتند از:

موتور، قلب موتور آسانسور است. موتور، انرژی الکتریکی را به انرژی مکانیکی تبدیل می کند و حرکت کابین آسانسور را تامین می نماید. موتورهای آسانسور معمولا بسته به نوع سیستم آسانسور مورد استفاده، موتورهای القایی AC یا موتورهای آهنربای دائم بدون چرخ دنده هستند. این موتورها، راندمان بالا و عملکرد قابل اعتمادی را ارائه می دهند.

- سیستم قرقره یا سیستم کششی (Sheave and Pulley System)

سیستم قرقره که به سیستم کششی نیز معروف است، وظیفه پشتیبانی و هدایت کابین آسانسور را در امتداد شفت عمودی بر عهده دارد. این سیستم، از یک چرخ شیاردار و یک یا چند طناب کششی یا تسمه تشکیل شده است. موتور، توسط شیارهای فلکه کشش کابین آسانسور را با بلند کردن یا پایین آوردن طناب ها به حرکت در می آورد.

سیستم کنترل، مغز موتور آسانسور است. سیستم کنترل، عملکرد آسانسور را مدیریت کرده و فرمان هایی را به موتور ارائه می دهد و ویژگی های ایمنی مختلف را مدیریت می کند. سیستم کنترل، موقعیت، سرعت و جهت آسانسور را کنترل کرده تا از حرکت صاف و دقیق بین طبقات اطمینان حاصل نماید. همچنین، سیستم کنترل، باز و بسته شدن درهای آسانسور را کنترل می کند.

مکانیزم ترمز، یک ویژگی ایمنی می باشد که از حرکت کابین آسانسور در زمان عدم استفاده یا در مواقع اضطراری جلوگیری می کند. این مکانیزم، شامل ترمزهای اصطکاکی یا ترمزهای الکترومغناطیسی است که وقتی آسانسور ساکن شود، کار می کنند. هنگامی که موتور، فرمان حرکت آسانسور را دریافت می کند، مکانیزم ترمز، آزاد می شود.

پوسته موتور که به نام محفظه موتور نیز شناخته می شود، یک پوشش بیرونی محافظ است که اجزای داخلی موتور آسانسور را در بر می گیرد. این لایه عایق، موتور را در برابر عوامل خارجی مانند گرد و غبار، رطوبت و آسیب فیزیکی محافظت می کند.

شفت موتور جزء دوار موتور آسانسور است که نیروی مکانیکی را انتقال می دهد. این بخش موتور را به سیستم محرک آسانسور متصل می کند و با چرخاندن فلکه یا قرقره محرک، کابین آسانسور را به حرکت در می آورد.

بلبرینگ ها اجزای مکانیکی هستند که برای کاهش اصطکاک و پشتیبانی از چرخش صاف شفت ها در موتور آسانسور استفاده می شوند. آنها از گلوله های فلزی کوچکی تشکیل شده اند که بین دو حلقه می چرخند و اصطکاک را به حداقل می رساند و امکان حرکت کارآمد را فراهم می کنند.

استاتور قسمت ثابت موتور آسانسور است که میدان مغناطیسی ایجاد می کند. معمولا از سیم پیچ هایی تشکیل شده که دارای جریان الکتریکی هستند. هنگامی که جریان از سیم پیچ ها عبور می کند، میدان مغناطیسی ایجاد می شود که نیروی لازم برای کار موتور را ایجاد می کند.

روتور قسمت دوار موتور آسانسور است. معمولا این بخش از یک هسته مرکزی و عناصر رسانا (مانند میله ها یا سیم پیچ ها) تشکیل شده که با میدان مغناطیسی تولید شده توسط استاتور تعامل دارند. همانطور که میدان های مغناطیسی برهم کنش می کنند، باعث حرکت در روتور شده و در نتیجه شفت موتور را می چرخانند.

انکودر سنسوری است که در موتورهای آسانسور برای تعیین موقعیت و سرعت شفت موتور استفاده می شود. این بخش بازخورد سیستم کنترل آسانسور و امکان کنترل دقیق حرکات کابین آسانسور را فراهم می کند. انکودر تعداد چرخش شفت یا موقعیت زاویه ای را اندازه گیری می کند که برای حفظ ایمنی و کارایی آسانسور ضروری است.

تفاوت موتور آسانسور گیرلس و گیربکس

یک موتور آسانسور بدون دنده (گیرلس) با سیستم محرک مستقیم آن مشخص می شود. در این نوع، موتور مستقیما به فلکه بالابر متصل خواهد شد. این طراحی، نیاز به گیربکس را از بین می برد و در نتیجه سیستم موتوری ساده تر و فشرده تر ایجاد می شود. از طرفی گیربکس در آسانسورهای مجهز به موتور گیربکس استفاده می شود. این موتور الکتریکی، وظیفه تنظیم سرعت و گشتاور مورد نیاز برای حرکت آسانسور را بر عهده دارد. گیربکس ها باعث می شوند، موتور، با سرعت بالاتری کار کند. در جدول زیر تفاوت های هر یک را بیان کرده ایم.

موتور آسانسور جزء مهمی است که وظیفه تامین انرژی حرکت کابین آسانسور را بر عهده دارد. اگر به موتور آسانسور نیاز دارید، ما اینجا هستیم تا محصولات باکیفیت، خدمات استثنایی و تجربه خریدی بی نظیر را به شما ارائه دهیم. ما در شرکت آسانسور فعال، در تامین موتورهای آسانسور درجه یک و مطابق با استانداردهای صنعت، تخصص داریم. ما اهمیت موتورهای آسانسور قابل اعتماد و کارآمد را در تضمین ایمنی و رضایت مسافران درک می کنیم. هنگامی که شما موتور آسانسور را از ما می خرید، می توانید انتظار مزایای متعددی داشته باشید. طیف موتورهای ما متنوع است و برای اندازه ها، سرعت ها و ظرفیت های بار آسانسور متفاوت، مناسب می باشد.

ما در آسانسور فعال، کیفیت و دوام را در اولویت قرار می دهیم. موتورهای آسانسور ما به گونه ای ساخته شده اند که در برابر استفاده مکرر مقاومت کرده و عملکرد طولانی مدت را تضمین می کنند. با سرمایه گذاری در محصولات ما، روی ایمنی و طول عمر سیستم آسانسور خود سرمایه گذاری می کنید. تیم کارشناسان ما برای کمک به شما در طول فرآیند خرید در دسترس هستند. آنها به شما کمک می کنند تا موتور مناسبی را برای نیازهای خود انتخاب کنید و به هر گونه سؤال یا نگرانی شما رسیدگی خواهند کرد. برای کسب اطلاعات بیشتر و خرید موتور آسانسور، با ما تماس بگیرید.

چه نوع موتور آسانسوری برای حمل بارهای سنگین و حساس مناسب است؟

انتخاب موتور آسانسور مناسب برای حمل بار های سنگین و حساس یک موضوع بسیار مهم است. به همین دلیل ، نیاز است تا به این موضوع با دقت و حساسیت بالایی توجه شود. در واقع موتوری که برای این آسانسور ها انتخاب می شود، بایستی عملکرد قوی، پایداری بالا و کنترل دقیق داشته باشد. از این رو از دو نوع موتور آسانسور گیربکس و موتورهای ترکیبی برای حمل بار های سنگین و حساس در آسانسور ها استفاده می شود. در ادامه هر یک از این موتور ها را به طور کامل تر برای شما شرح داده ایم.

موتور های گیربکس برای استفاده در این نوع از آسانسور ها بسیار مناسب هستند. این نوع موتورها برای تغییر سرعت و افزایش گشتاور از گیربکس استفاده میکنند. موتور های گیربکس دار قدرت و پایداری بسیار بالایی داشته و به راحتی می توانند بار های سنگین را حمل کنند.

این نوع موتورها دارای ساختاری ساده تر و البته کارآمد هستند. استفاده از موتور های ترکیبی برای آسانسورهای با سرعت بالا بسیار مناسب بوده و می توان با اطمینان خاطر از آن ها برای حمل بار های سنگین یا حساس استفاده کرد.

چه نوع موتور آسانسوری برای ساختمان های کوچک و محدود مناسب است؟

آسانسور ها تنها برای استفاده در ساختمان های بزرگ مورد استفاده قرار نمی گیرند. بلکه ممکن است افراد به دلایل مختلف و بر حسب نیاز یا صرفا بخاطر علاقه خود، به استفاده از آسانسور در ساختمان های کوچک و محدود اقدام کنند. در این مواقع افراد در انتخاب نوع آسانسور و موتور آن با محدودیت های مختلفی رو به رو می شوند. به همین دلیل نیز به دنبال یک گزینه مناسب هستند.

برای ساختمان های کوچک و محدود استفاده از موتور آسانسورهای گیربکس دار یک گزینه ایده آل به حساب می آید. در واقع موتور های گیربکس دار ابعاد و اندازه های کوچکی دارند و به راحتی میتوان آن ها را در فضا های محدودی نصب کرد. موتور های گیربکس دار در اغلب مواقع برای آسانسور های با ارتفاع پایین و طبقات محدود که تردد کمی دارند، مورد استفاده قرار میگیرند.

شما می توانید از آسانسور با موتور گیربکس دار در ساختمان های آپارتمانی کوچک، ساختمانهای اداری با تعداد طبقات کم و منازل شخصی، استفاده کنید. البته شایان ذکر است که قبل از اقدام به خرید و نصب آسانسور بهتر است که با یک مشاور یا شرکت نصاب که در این زمینه تخصص دارد، مشورت بگیرید تا بتوانید با توجه به شرایط خاص خود، بهترین نوع آسانسور را انتخاب کنید.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.JPG)

.jpg)

.jpg)

ارسال نظر

نکته: HTML ترجمه نمی شود!