تعمیر آسانسور 1403 با پشتیبانی 24 ساعته

تعمیر آسانسور به مجموعه خدماتی گفته می شود که در گروه سرویس و نگهداری شرکت های خدمات آسانسور ارائه می گردد. زمانی که عملکرد متداول آسانسور با اختلال روبرو شود، نشان دهنده عیب یا نقص درعملکرد یا فرسودگی قطعات آسانسوراست و باید به سرعت با واحد تعمیر آسانسور شرکت برای بازرسی و تعمیرات تماس گرفته شود. آسانسورها دارای سیستم های پیچیده و مدارهای متعدد جهت ایمنی هستند و به مرور زمان و دراثرفرسودگی نیازمند سرویس و تعمیرات خواهند بود. اگر طراحی آسانسور، با کیفیت و مطابق استاندارد ها انجام شده باشد، طول مدت عملکرد بهینه برای آن بیشتر است؛ اما آسانسورهای بی کیفیت یا ساخته شده با مصالح اولیه نامناسب در کوتاه مدت و به سرعت دچار عیب یا خرابی می شوند. ویکی پدیا انواع آسانسور را به تفصیل بیان نموده است.

نرخ نامه مصوب سندیکا برای قرارداد سرویس و نگهداری یکساله آسانسور سال 1403

مهم ترین دلیل توجه به بازرسی و تعمیر آسانسور چیست؟

اهمیت بازرسی و تعمیر آسانسور به اندازه ای است که با ایمنی و سلامت افراد در ارتباط است. نه تنها شرکت های ارائه دهنده خدمات آسانسور وظیفه دارند محصولات خود را به صورت دوره ای بازرسی کنند، بلکه صاحبان و مدیران ساختمان ها باید به صورت روزانه یا ماهانه، عملکرد آسانسور را کنترل کنند. بازرسی عملکرد آسانسور از هزینههای هنگفتی که در آینده برای تعمیرات و نگهداری به وجود می آید، جلوگیری می کند. اگر در ساختمانی زندگی می کنید که مجهز به آسانسور است، شاید ترجیح می دهید نشانه های خرابی آسانسور یا علائم متداول برای این تجهیزات را بشناسید. در ادامه به خدمات شرکت آسانسور برای بازرسی ، تعمیرات و نگهداری آن اشاره ای خواهیم داشت.

تعمیر آسانسور چه زمانی ضروری است؟

اگر به هر دلیلی عملکرد صحیح آسانسور دچار اختلال شود، خدمات تعمیر آسانسور ضرورت خواهد داشت. عوامل زیادی وجود دارند که باعث نقص در این عملکرد می شوند. این عوامل اگر به سرعت برطرف نشوند موجب خرابی آسانسور شده و شاید مجبور باشید قطعات اصلی یا کل سیستم آسانسور را تعویض کنید. به طور متداول، مدت زمان خاصی که از کارکرد آسانسورها می گذرد قطعات آن دچار استهلاک و فرسودگی می شوند. در صورت استفاده غیر صحیح از آسانسور، این فرسودگی شدت پیدا میکند. به طور مثال، اگر با آسانسورهای مجتمع های مسکونی بارهای سنگین جابه جا کنید که بیشتر از حداکثر ظرفیت بار آسانسور باشد، قطعات بالا برنده یا سیم بکسل فولادی دچار فرسودگی می شود.

یکی از عواملی که باعث خرابی آسانسور می شود همین فرسودگی طناب های فولادی یا سیم بکسل است. اگر چه رشته های فولادی بسیار مقاوم هستند اما در معرض کشیدگی و خوردگی قرار دارند؛ به مرور زمان این تأثیرات مشاهده می شود و اگر تعمیر آسانسور را انجام ندهید، ایمنی عملکرد آن به خطر می افتد. طناب های فولادی به طور مستقیم با ترمز آسانسور و موتور آسانسور در ارتباط هستند.

حرکت به سمت بالا و پایین توسط این طناب های فولادی مقاوم کنترل می شود. پوسیده شدن آنها بر حرکت نرم و آرام اتاقک آسانسور تاثیر گذاشته و اگر اصطکاک لازم را نداشته باشد ممکن است کنترل اتاقک از بین برود و کابین آسانسور دچار سرخوردگی شود. تمام عواملی که باعث خرابی آسانسور می شوند نیاز به رسیدگی دارند؛ در غیر این صورت، جان افراد را تهدید خواهند کرد.

خدمات تعمیر آسانسور را از بهترین شرکت دریافت کنید!

بررسی عملکرد درست روزانه آسانسور بر عهده مدیر و ساکنین ساختمان است. با این حال، بهترین شرکت آسانسور وظیفه دارد تکنسین های آموزش دیده خود را در هر ماه یک بار به ساختمان ها اعزام کند تا عملکرد آسانسور را کنترل کنند. تکنسین هایی که برای تعمیرات و نگهداری آسانسور با شرکت ها همکاری می کنند افرادی هستند که در این حوزه، دانش، تجربه و مهارت دارند.

این افراد با قطعات مختلف آسانسور به طور کامل آشنایی داشته و نحوه بازرسی تعمیرات و نگهداری آنها را می دانند. درتعمیر آسانسور، اگر وضعیت خرابی قطعات بسیار شدید باشد، تعویض بخش های آسیب دیده ضرورت خواهد داشت. تشخیص تعویض قطعات خرابی آسانسور بر عهده همین تکنسین ها است. برای سهولت کار تعمیرات و نگهداری آسانسور معمولاً یک سری چک لیست کنترل و بازرسی وجود دارد که بر اساس آن می توان عملکرد آسانسور را ارزیابی کرد.

روش دیگری که برای بازرسی آسانسور وجود دارد، کنترل تجهیزاتی است که به پنل کنترل و فرمان برق مربوط می شود. تمام تجهیزات ابزار دقیق و قطعات برقی که در داخل تابلو برق آسانسور وجود دارد باید به صورت دوره ای بررسی شوند. به طور مثال، فیوزها، اتصالات تابلو برق، اتصالات موتور آسانسور، بررسی وضعیت شفت اینکودر موتور، کنترل سطح روغن موتور در آسانسورهای هیدرولیک و کنترل دمای محفظه موتورخانه آسانسور، مواردی هستند که بسیار اهمیت دارند.

اگر دمای محیط موتورخانه افزایش پیدا کند، سیستم برق با اختلال مواجه می شود، فیوزها عمل نمی کنند و کوچک ترین جرقه منجر به آتش سوزی می شود. از دیگر قسمت هایی که در تعمیر آسانسور به آن توجه می شود عملکرد صحیح درب آسانسور، نحوه حرکت یا توقف آرام آسانسور در هر طبقه و عملکرد مناسب کلید های احضار در داخل کابین است.

خدمات تعمیرات- نگهداری آسانسور، هم به صورت جزئی برای قطعات و هم به صورت کلی برای تمام سیستم ارائه می شود. یک تکنسین آسانسور در فرایند جنرال سرویس، تمام سیستم آسانسور را بازرسی می کند و اگر خرابی وجود داشته باشد آن را برطرف می کند. در تعمیرات و نگهداری آسانسور، رعایت استانداردها ضرورت دارد. این خدمات کمک می کنند که هزینه ها تا حد امکان کاهش داشته باشد. اگر نسبت به بازرسی دوره ای آسانسور ساختمان توجه زیادی به خرج دهید در هزینه های تعمیر آسانسور یا تعویض قطعات، صرفه جویی خواهید کرد.

آموزش نحوه تعمیر آسانسور

نحوه تعمیر آسانسور خانگی با روش تعمیر آسانسورهای صنعتی یا آسانسورهایی که در ساختمان های تجاری و مراکز خرید وجود دارند با هم متفاوت است. تکنسین هایی که برای تعمیرات آسانسور اعزام می شوند از تمام فنون و تکنیک های تخصصی اطلاع دارند. تکنسین های مسئول تعمیرات آسانسور از سطح بالایی دانش تخصصی برخوردار هستند و با مهارت خود می توانند عملکرد مناسب آسانسور را فراهم کنند.

تجهیزات آسانسور بسیار پیچیده است و قطعات مختلفی را در بر می گیرد. هر کدام از این قسمت ها ممکن است نیاز به تعمیرات اساسی داشته باشند. نحوه تعمیر آسانسور با توجه به مشکلاتی که به وجود آمده است اجرا می شود. اگر قطعات مختلف آسانسور حتی کوچکترین مشکلی پیدا کنند، در طولانی مدت بر عملکرد و حرکت کلی آسانسور تاثیر منفی خواهند داشت. در همین راستا لازم به ذکر است که هنگام خرید آسانسور به این نکته توجه کنید که تمام تجهیزات از کیفیت بالایی برخوردار باشند.

در دستورالعمل نحوه تعمیر آسانسور به موارد اصلی و جزئیات اشاره شده است. مثلاً شما به تجهیزات اصلی نظیر تابلو برق آسانسور، کابین آسانسور، سیستم برق، طناب های آسانسور، کابل ها و موتور آسانسور باید توجه کنید. هر یک از این تجهیزات اصلی به تنهایی از قسمت های کوچک تری تشکیل شده است که آنها هم نیاز به تعمیرات پیدا میکنند. از آنجایی که نحوه تعمیر آسانسور که از طریق شرکت های مختلف ارائه می شود شباهت زیادی به یکدیگر دارد، در ادامه این قسمت به مهمترین اصول برای تعمیرات آسانسور اشاره می کنیم.

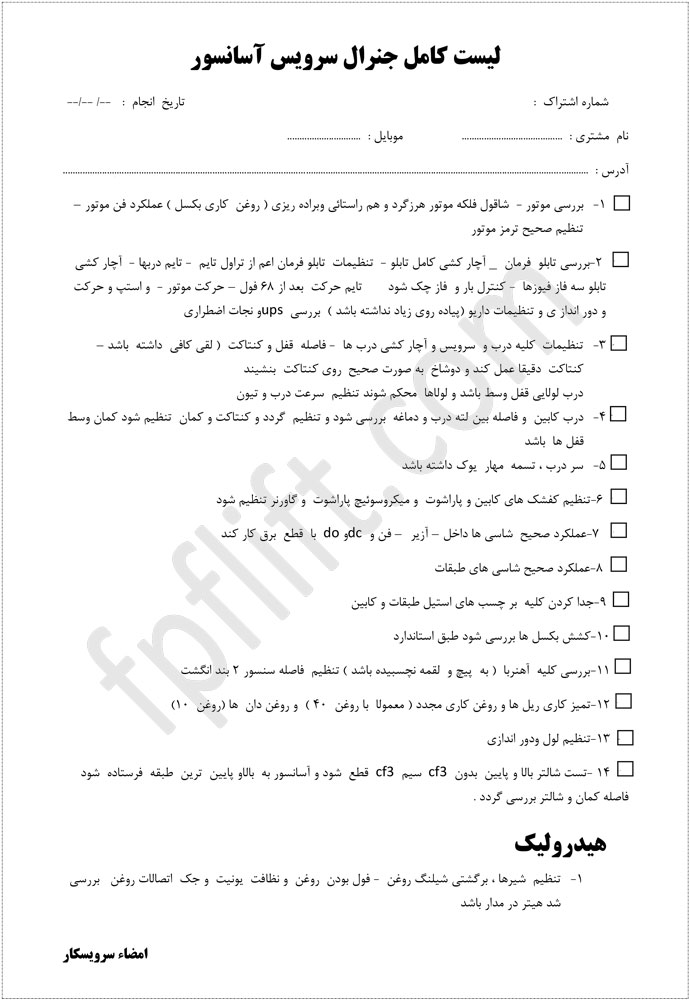

لیست کامل جنرال سرویس آسانسور

نحوه تعمیر آسانسور در قسمت های مختلف چگونه انجام می شود؟

برای اینکه درک دستورالعمل تعمیرات آسانسور برای شما راحت تر باشد، این قسمت را به صورت فهرست گونه معرفی می کنیم. به این ترتیب راحت تر می توانید اهمیت اجرای صحیح نحوه تعمیر آسانسور را متوجه شوید. در ادامه متوجه خواهید شد که خدمات تعمیرات آسانسور را باید از شرکت های معتبر دریافت کنید تا به بهترین شکل برای شما به اجرا درآید.

- برای تعمیر آسانسور در تابلو برق باید به فیوزها، سیم ها و کابل ها، کلیدهای برق و اتصالات توجه کنید. اگر روکش سیم ها و کابل ها دچار ترک خوردگی شده باشد، یا به هر دلیلی سیم ها روکش خود را از دست داده باشند، در اولین فرصت باید سیم ها یا کابل های آسیب دیده را جایگزین کنید.

- تعمیرات آسانسور در قسمت کابین آسانسور شامل سقف آسانسور، دیواره ها و کفپوش است. هر کدام از این قسمت ها باید سالم باشند و ترک خوردگی نداشته باشد؛ یا از حالت مسطح، انحراف پیدا نکرده باشند. هر گونه تغییر از حالت عادی نیاز به تعمیرات خواهد داشت؛ در غیر این صورت، ایمنی افراد به خطر می افتد.

- نحوه تعمیرات آسانسور به این صورت است که تکنسین ها به صورت دوره ای با توجه به کاربرد آسانسور در یک ساختمان از این تجهیزات بازدید می کنند. چک لیست تعمیرات آسانسور، بهترین ابزار است که می تواند نشان دهد عملکرد آسانسور در دوره های زمانی مختلف چگونه بوده است. موضوع تعمیرات- نگهداری آسانسور، سرویس آسانسور و بازرسی آسانسور از هر جهت اهمیت دارد و حتی نباید کوچکترین کوتاهی در انجام آنها صورت بگیرد.

تفاوت تعمیر آسانسور با تعمیر بالابر چیست؟

اگرچه آسانسورها نوعی بالابر هستند، بالابرها نوع ساده ای از این تجهیزات هستند که تعمیرات آنها به ساده ترین روش امکان پذیر است. نحوه تعمیر آسانسورهای بزرگ تر با قطعات پیچیده تر، دشوارتر است، بنابراین به زمان و مهارت بیشتری نیاز دارند. بالابرها تجهیزات ساده ای هستند که در رستوران ها و کارخانه ها یا صنایع، آنها را دیده اید. تعمیر بالابرها در کوتاه ترین زمان انجام می گیرد، بنابراین مهمترین تفاوت تعمیرات آسانسور خانگی یا تجاری و بالابرها را می توان زمان تعمیرات معرفی کرد. برای بررسی نحوه تعمیر آسانسور و بالابر، شرکت های مختلف بهترین تکنسین ها را در کنار خود دارند تا این خدمات را به بهترین شکل به مشتریان عزیز ارائه دهند. اگر به خدمات تعمیرات، نگهداری و بازرسی آسانسور نیاز داریم یا می خواهید آسانسور جدید بخرید، با کارشناسان ما تماس بگیرید.

تعمیر آسانسور در تهران

خدمات تعمیر آسانسور در تهران برای تمام آسانسورهای در حال استفاده در قسمت های مختلف شهر در ساختمان های مختلف ارائه می شود. آسانسورها بخش مهمی از زندگی روزمره همه ما هستند و زندگی را آسان تر می کنند. با آسانسور می توانیم سریع تر به طبقات مختلف ساختمان برویم؛ حتی بسیاری از آسانسورها این اجازه را می دهند که کالاها یا بیماران خود را بین طبقات جابجا کنیم.

با این حال حتی اگر متوجه نشویم، آسانسورها نیاز به تعمیرات پیدا می کنند. خدمات و نگهداری مداوم از آسانسورها باعث می شود عملکرد آنها در طولانی مدت مختل نشود. کارشناسان توصیه می کنند که بهتر است آسانسورها دو بار در سال، بازرسی و نگهداری شوند. با برنامه تعمیر آسانسور در تهران به صورت منظم که توسط تکنسین های آموزش دیده به اجرا در می آید، می توان مطمئن بود که آیا همه اجزای آسانسور به درستی کار می کنند یا باید قطعات، تعمیر و تعویض شوند. اگر به دنبال بهترین شرکت هستید که تعمیر آسانسور در تهران را ارائه دهد، چند نکته وجود دارد که بهتر است به آنها توجه داشته باشید.

نکات مهم برای انتخاب شرکت تعمیر آسانسور در تهران

مواردی که هنگام استفاده از خدمات شرکت تعمیر آسانسور در تهران باید در نظر بگیرید:

- اگر به هر دلیلی آسانسور شما خراب شده است یا نیاز به تعمیرات، بازرسی یا تعویض قطعات دارد، بهترین شرکت تعمیرات آسانسور در تهران را پیدا کنید. هنگام انتخاب تکنسین های شرکت برای خدمات باید به میزان مهارت و حرفه ای بودن آنها در این حوزه توجه داشته باشید.

- یکی از مواردی که در استفاده از خدمات تعمیر آسانسور در تهران اهمیت دارد، هزینه ها و قیمت ها است. قیمت تعمیر آسانسور در مناطق مختلف تهران، نرخ متفاوتی دارد. زمانی که با شرکت ها تماس می گیرید تا تکنسین ها را به محل شما اعزام کنند، درباره نحوه ارائه خدمات و کیفیت خدمات و قیمت تعمیرات آسانسور حتماً صحبت کنید.

- یکی از نکات مهم برای ارزیابی یک شرکت تعمیر آسانسور این است که خدمات تعمیرات یا اعزام تکنسین هارا در چه ساعاتی از شبانه روز ارائه می دهد؛ و خدمات پشتیبانی مشتریان به چه صورت است. بسیاری از شرکت های تعمیرات آسانسور، خدمات خود را به صورت ۲۴ ساعته و ۷ روز هفته را ارائه می دهند تا رضایت مندی مشتریان جلب شود.البته این نوع خدمات قطعا نرخ بالاتری نست به تعرفه ها دارند.

- سعی کنید از شرکت هایی استفاده کنید که تعمیر آسانسور در تهران را با اعتبار و اطمینان بالا ارائه می دهند. شهرت یک شرکت نشان می دهد چقدر در کار خود حرفه ای است و چه تکنسین های باتجربه ای را در اختیار دارد. این گونه بررسی ها به شما کمک می کند شرکت های با تجربه و معتبر را انتخاب کنید و از کیفیت خدمات آنها مطمئن شوید.

- نکته مهم دیگر که هنگام خدمات تعمیر آسانسور در تهران باید در نظر بگیرید گارانتی خدمات است. شرکت هایی هستند که خدمات خود را با ضمانت و گارانتی ارائه می دهند. برخی شرکت های تعمیرات آسانسور، خدمات خود را ماه ها گارانتی می کنند که در این صورت، اگر خرابی در آسانسور اتفاق افتد، تعمیرات- نگهداری به صورت رایگان ارائه خواهد شد.نحوه عملکرد شرکت آسانسور فعال دقیقا اینگونه است. ما بعداز عقد قرار دادسرویس و نگهداری ، تعمیرات آسانسور را تا یک سال گارانتی میکنیم.

مزایای خدمات تعمیر آسانسور در تهران

- اگرچه آسانسورها تجهیزات پیچیده ای هستند، اما اگر خدمات تعمیرات آسانسور در تهران را از شرکت های باتجربه دریافت کنید، مزایای زیادی برای شما دارد. اولین و مهمترین مزیت این است که از خرابی بیش از حد آسانسور جلوگیری خواهید کرد و این یعنی کاهش هزینه های هنگفت که در آینده قرار است به شما تحمیل شود.

- یکی دیگر از مزایای خدمات تعمیرات آسانسور در تهران این است که طبق یک قرارداد ثابت می توانید در مدت زمان دلخواه خود، این خدمات را دریافت کنید. این ویژگی یک امتیاز مثبت است که نگرانی های خرابی آسانسور را برطرف می کند.

- مزیت دیگر این است که شرکت تعمیر آسانسور در تهران برای مشتریان دائم خود، تخفیف های خوبی در نظر می گیرد؛ بنابراین اگر قیمت و هزینه ها برای شما اهمیت دارد، با یک قرارداد طولانی مدت برای تعمیرات، نگهداری و بازرسی آسانسور می توانید تخفیف های خوبی از شرکت ها بگیرید.

چگونه بهترین شرکت تعمیر آسانسور را پیدا کنیم؟

پیدا کردن بهترین شرکت تعمیر آسانسور یک امر ضروری است. شما با چند راهکار ساده می توانید بهترین شرکت های حرفه ای را پیدا کنید. انتخاب شرکت تعمیرات و نگهداری آسانسور بر اساس معیارهای خاصی صورت می گیرد. از آنجایی که در مقالات مختلف، بارها درباره خدمات آسانسور صحبت کرده ایم، لازم می دانیم در این مطلب مجزا، راهکارهایی را اشاره کنیم که به شما کمک می کنند بهترین شرکت را برای تعمیر آسانسور پیدا کنید.

پیدا کردن بهترین شرکت تعمیر آسانسور و خدمات آسانسور، کار نسبتاً دشواری است. هر کدام از شرکت ها هزینه های متفاوتی را برای این خدمات در نظر میگیرند و عملکرد کلی آنها قابل توجه است. چالش مهم این است که هنگام پیدا کردن این شرکت ها باید به دنبال چه چیزی باشید؛ به عبارت دیگر می خواهیم بگوییم چه معیارهایی مهم هستند که شما می توانید بر اساس آن، شرکت های آسانسور را پیدا کنید.

معیارهای مهم برای انتخاب بهترین شرکت تعمیر آسانسور

- داشتن تجربه و تخصص در زمینه انواع آسانسور- نصب آسانسور- بازرسی آسانسور و تعمیرات- نگهداری آسانسور

- استفاده از بهترین تکنسین های دوره دیده و آموزش دیده برای ارائه خدمات

- به کارگیری مهندسان مکانیک و مهندسان برق برای همکاری با مشتریان و تکنسین ها

- استفاده از تجهیزات برقی و ابزار دقیق و لوازم مورد نیاز برای نصب آسانسور و تعمیرات و بازرسی آسانسور

- برنامه ریزی دقیق برای چک لیست تعمیر آسانسور- بازرسی آسانسور و ارائه گزارش های دقیق

- توانایی تنظیم نرم افزارهای آسانسور و یکپارچه سازی آن با قسمت های سخت افزاری

- دسترسی آسان به شرکت و ارائه خدمات گسترده به تمام مناطق اطراف

- ارائه خدمات مختلف برای نصب و تعمیرات آسانسور در مناطق دورتر

- داشتن برنامه دقیق برای حمل و نقل آسانسور- تامین قطعات یا سرویس دهی به تمام ساختمان ها

- ارائه خدمات اورژانسی و فوری برای تعمیر آسانسور در ۲۴ ساعت شبانه روز

- سهولت در تعمیرات آسانسور و تأمین منابع و قطعات و لوازم یدکی مورد نیاز

- داشتن مشاوران برای تعمیرات آسانسور یا خرید آسانسور

- خدمات گارانتی و مشاوره مشتریان حتی پس از فروش آسانسور یا خدمات آسانسور

- ارتباط صحیح و مثبت با مشتریان و همیاری و همکاری با آنها توسط یک تیم تخصصی

- عقد قرارداد طولانی مدت با مدیران ساختمان ها برای سرویس- بازرسی- نگهداری وتعمیر آسانسور و ارائه تخفیف های مناسب

با توجه به هزینه های قابل توجه که تعمیرات- نگهداری آسانسور به شما تحمیل می کند، انتخاب عاقلانه ای خواهد بود اگر بهترین شرکت تعمیر آسانسور را پیدا کنید. خدمات آسانسور اگر با کیفیت ارائه شود خطرات عدم ایمنی را کاهش می دهد و عملکرد کلی تجهیزات را بهبود می بخشد. صاحبان ساختمان ها و مدیران ساختمان های بزرگ، هتل ها و مجتمع های تجاری و اداری بهتر است با رعایت نکاتی که در قسمت قبل اشاره کردیم بهترین شرکت را در شهر خود برای تعمیر آسانسور پیدا کنند.

حتی شرکت هایی هستند که در شهرهای دیگر فعالیت می کنند و خدمات تعمیر آسانسور را برای شهرهای مختلف نیز ارائه می دهند. قطعاً این شرکت ها شعبه های فعال و معتبری دارند که تمام این موارد را رسیدگی می کنند. اگر برای خرید آسانسور نیاز به مشاوره دارید یا می خواهید ویژگی های خدمات ما را بررسی کنید، با کارشناسان فروش یا مشاوران ما تماس بگیرید.

روشی ساده برای پیدا کردن بهترین شرکت تعمیر آسانسور

از آنجایی که کسب و کارها در دنیای اینترنت بسیار رشد و توسعه پیدا کرده اند، دور از انتظار نیست که بتوان با یک جستجوی ساده در موتور جستجوگر گوگل، بهترین شرکت تعمیر آسانسور را در شهر خود پیدا کنید. اگر به خدمات تعمیرات آسانسور در اصفهان نیاز دارید، یا حتی میخواهید این خدمات را برای تهران دریافت کنید، کافیست همین شرکت ها را با همین کلیدواژه ها جستجو کنید. این روش، بسیار ساده است. اگر شما به وب سایت شرکت آسانسور هدایت شدید، حتماً از نمونه کارهای ارائه شده بازدید کنید و سوابق شرکت را بررسی نمایید و در صورت لزوم با کارشناسان شرکت تماس بگیرید.

تعمیر دکمه آسانسور

امروزه آسانسور ها نقش مهم و ویژه ای در ساختمان ها و آپارتمان های بلند و دارای پله های زیاد، دارند. این وسیله پرکاربرد سال هاست در سراسر جهان مورد استفاده و استقبال شدیدی قرار گرفته و از آن برای راحتی بیشتر در هنگام رفت و آمد و بالا و پایین رفتن در ساختمان ها استفاده می شود. امروزه آسانسورها جای استفاده از پلهها را گرفته اند و مگر در موارد خرابی آسانسور کسی از پله استفاده نمیکند.

آسانسورها بعد از گذشت مدتی دچار فرسودگی و خرابی می شوند، این خرابی ها می تواند از اجزای داخلی مثل موتور و تابلو فرمان و ... و همچنین موارد ظاهری آسانسور شکل بگیرد. اما یکی از شایع ترین خرابی این وسیله، خرابی دکمه آسانسور است. همانطور که می دانید دکمه آسانسور یکی از اجزای مهم این وسیله به شمار می رود. به بیانی ساده، تمامی کارایی آسانسور به وجود همین دکمه وابسته است. شما با دکمه آسانسور می توانید شماره طبقات مدنظرتان را انتخاب کنید. همچنین در صورت وقوع حادثه، فشردن دکمه آژیر موجود بر روی برد دکمه های مختلف آسانسور، می تواند بهترین کمک برای شما باشد.

طبیعتاً هر چقدر که ما از آسانسور و دکمه آن کمتر استفاده کنیم، طول عمر آن بیشتر خواهد بود. البته تمامی شرکت های معتبر ارائه دهنده خدمات آسانسور، با ارائه خدمات پس از فروش خود، به راحتی تعمیر دکمه آسانسور را انجام می دهند. در این مقاله ما قصد داریم درباره نحوه تعمیر دکمه آسانسور صحبت کنیم و اطلاعات بیشتر و دقیق تری را در این زمینه در اختیار شما قرار دهیم.

چرا به تعمیر دکمه آسانسور نیاز داریم؟

یکی از دلایل مهم خرابی دکمه آسانسور، فشار دادن بیش از حد و محکم این دکمه ها است. در مراکز اداری و تجاری، رفت و آمد افراد و استفاده آنها از آسانسور به مراتب بیشتر از ساختمان های مسکونی است. به همین دلیل خرابی دکمه آسانسور بیشتر در این ساختمان ها رخ می دهد. یکی از مهم ترین علائم خرابی دکمه های آسانسور، عدم حرکت درست و ایست درست در طبقات و اختلال در باز و بسته شدن درب ها است.

شرکت های معتبر برای تعمیر دکمه آسانسور

شما می توانید برای تعمیر دکمه آسانسور ساختمان تان با شرکتی که از آن آسانسور را خریداری کردید، تماس بگیرید تا تیم تعمیر و سرویس خود را برای ارائه خدمات، نزد شما بفرستند و دکمه آسانسور را تعمیر یا تعویض نمایند. شرکت های مختلف و زیادی در سر تا سر ایران وجود دارند که می توانند این خدمات را به شما عزیزان ارائه دهند. البته افراد بهتر است با یک شرکت معتبر قرارداد سرویس و نگهداری منعقد کنند و این خدمات را از آنها درخواست کنند. این شرکت ها با طی نمودن دوره کامل تعمیرات آسانسور، به عنوان یک متخصص، می توانند نه تنها تعمیرات دکمه آسانسور، بلکه تعمیرات کلی این اتاقک را انجام دهند.

نکاتی درباره تعمیر آسانسور

در برخی از مواقع، بسیاری از افراد در استفاده از آسانسور نکات لازم و ضروری را رعایت نمی نمایند. این امر سبب می شود تا قطعات آسانسور در طول مدت زمان استفاده از بین بروند و آسانسور نیاز به تعمیر پیدا کند. البته فراموش نکنید که سرویس های دوره ای، با تعمیر آسانسور متفاوت است؛ در سرویس های دوره ای، افراد متخصص بخش هایی از آسانسور را روغن کاری، آچار کشی و برخی از قطعات مصرفی را تعویض می نمایند.

در بسیاری از مواقع، ممکن است صدا هایی را در آسانسور احساس کنید که آنچنان خوشایند نیستند و ممکن است شما را بترسانند. آسانسور ها می توانند حتی با کوچک ترین عیب، از کار بیافتند و متوقف شوند. برای این که با مشکلات مواجه نشوید، می بایست در مرحله اول به صورت درست از آسانسور استفاده نمایید و در مرحله دوم، می بایست سرویس های دوره ای را طبق زمان تعیین شده انجام دهید تا دچار مشکل نشوید. برای تعمیر و سرویس های دوره ای آسانسور خود، می بایست حتما آن به دست افراد متخصص و با تجربه آسانسور بسپارید.

برای تعمیر آسانسور می بایست آن را دست افراد متخصص بسپارید. اما در برخی از موارد متخصصان به صورت خصوصی و متفرقه فعالیت می کنند و ممکن است هزینه تراشی بی مورد انجام داده و پس از تعمیر، هزینه بسیار بالایی را از شما درخواست کنند. پس برای آنکه بعد از تعمیرات و سرویس آسانسور خود با خیالی آسوده از آن استفاده نمایید و مبلغ کمتری را بپردازید، می بایست از شرکت های معتبرآسانسور، برای تعمیر و سرویس های دوره ای استفاده نمایید. مهم ترین مزایای این شرکت ها، دارا بودن مجوزهای لازم و تضمین کیفیت کار است و این امر سبب می شود تا بتوان با خیالی آسوده سوار آسانسور شد.

یکی از مهم ترین نکاتی که افراد در هنگام خرابی آسانسور، با آن جدی برخورد نمی کنند، تاخیر در مدت زمان تعمیر و صرفه جویی در هزینه ها است. بسیاری از افراد معتقد هستند که پس از خرابی آسانسور، آن ها می توانند مدت زمان بیشتری از آن استفاده نمایند بدون آن که آسیبی به اجزای دیگر برسد. ولی این امر به طور کل اشتباه است؛ چرا که اگر قطعه ای کوچک از آسانسور آسیب ببیند و سر موعد تعویض نگردد، سبب از بین رفتن اجزا و قطعات دیگر می شود و در نتیجه دیگر نمی توان در هزینه ها صرفه جویی نمود و می بایست هزینه های کلانی را برای تعمیر آسانسور بپردازید.

زمان مناسب تعمیر آسانسور

آسانسور برای بهتر کار کردن و طولانی بودن عمر کارکرد، نیاز به سرویس های دوره ای دارد. سرویس های دوره ای آسانسور می بایست طبق موعد انجام گردد تا مشکلات کوچک و قابل حل با هزینه های کم، برطرف شود. سرویس های دوره ای می بایست حداقل ماهی یک بار انجام شود. علاوه بر سرویس های دوره ای، مسافران می توانند برای اطمینان حاصل کردن از اعتبار استاندارد آسانسور، کد 8 الی 10 رقمی که بر روی دیواره کابین روی پلاک مخصوص حک شده است را به شماره پیامک درج شده ارسال نمایید تا بتوانید از اخذ شدن استاندارد آسانسور و مدت اعتبار آن اطمینان حاصل کنند.

در برخی از مواقع، ممکن است صدا های غیر عادی درون آسانسور به گوش شما برسد که سبب ترس شما شود. منشاء این صدا می تواند از اجزای آسانسور از جمله کابل های بالابر، بلبرینگ های موتور، گاورنر و حتی فن تهویه هوا باشد. در این زمان می بایست حتما با متخصصان تماس گرفته شود تا آن ها در اسرع وقت، پیگیر تعمیر آسانسور شما شوند.

ممکن است تا بحال با تاخیر آسانسور مواجه شده باشید؛ دیر باز شدن درب ها، تاخیر در بالا و پایین رفتن و تاخیر در پنل کلید فرمان می تواند جزو تاخیر های آسانسور محسوب گردد. این تاخیرات، نتیجه خوب کارنکردن برخی از اجزا بخصوص سنسور ها و قطعات الکتریکی است. اگر در اسرع وقت، برای تعمیر و تعویض آن ها اقدام نگردد، سبب می شود تا در حین حرکت ناگهان آسانسور از کار بیوفتد و شما برای مدتی در آسانسور محبوس بشوید. پیشنهاد می شود با مشاهده کردن کوچک ترین تاخیر، حتما کار را به دست متخصصان بسپارید تا دچار مشکل نشوید.

در بسیاری از مواقع، ممکن است مشاهده کرده باشید که آسانسور با سرعت بسیار کمی حرکت می کند و حتی برخی از مواقع توقف می کند. این امر می توان شروع یک مشکل بسیار بزرگ را در بر داشته باشد و آسیب های بسیار زیادی به اجزای آسانسور برساند که تعمیر کردن آن ها، پرداخت هزینه های بسیار بالایی را باعث شود . کند شدن سرعت آسانسور می تواند در اثر خوب کار نکردن ترمز موتور و یا خرابی در مدارات راه انداز موتور گیربکس باشد. در این زمان می بایست با متخصصان تماس بگیرید تا آن ها برای بازدید و عیب یابی آسانسور نزد شما آیند.

پر تکرارترین دلایل خرابی آسانسور

- بلبرینگ ها، یکی از مهم ترین اجزای چرخشی هر دستگاهی محسوب می شوند که دارای وجود حیاتی هستند. در بسیاری از آسانسور ها، بلبرینگ های بسیار زیادی وجود دارد. در برخی از مواقع ممکن است بلبرینگ ها با تولید صدا هایی به شما هشدار دهند که در حال خرابی و فرسایش هستند و می بایست برای تعویض آن ها اقدام شود. اگر بلبرینگ ها سر موقع تعویض نگردند، سبب آسیب رسیدن شدید به دیگر اجزا از جمله موتور می گردد.

- در بسیاری از مواقع، به دلیل فرسایش بیش از حد موتور و گیربکس براده های ریز آهنی به همراه گرد و غبار وارد موتور آسانسور می شود.در این موارد بایستی حتما تراز بوده موتور و کشش بکسل های چک شود.

- بسیاری از متخصصان برای تعمیر آسانسور، در ابتدا روغن آن را چک و در صورت لزوم تعویض می کنند.

- قطع برق نیز، می تواند یکی از دلایل خرابی آسانسور باشد. چرا که قطع برق سبب می شود تا کابین متوقف شود و چه بسا به اجزای الکتریکی آسانسور آسیب وارد شود.

پیشنهاد می شود که اگر سوار بر آسانسوری شدید و با کوچک ترین مشکل مواجه شدید، سریعا برای رفع آن اقدام نمایید تا دیگر اجزای آسانسور شما دچار مشکل نشوند و بتوانید مدت زمان طولانی از آسانسور خود استفاده نمایید.

تعمیر آسانسور آسیب دیده

امروزه در کارگاه های آسانسور سازی، تعمیر آسانسور ها به بهترین شکل ممکن انجام می شوند و متخصصان قادر به بازسازی آسانسور ها به بهترین شکل هستند. در بسیاری از مواقع، ممکن است برخی از آسانسور ها به دلیل سهل انگاری ساکنین و عدم سرویس ماهیانه ، صدمات و فرسودگی زیادی پیدا کنند و حتی کابین آن ها به دلیل مواردی چون اسباب کشی با آسانسور دچار آسیب گردد. متخصصان در کارگاه های آسانسور سازی قادر به تعمیرات کابین آسانسور و دیگر اجزا در بد ترین شرایط هستند و آن ها همانند روز اول تعمیر می نمایند. در ادامه با ما همراه باشید تا با مراحل تعمیرات آسانسور ضربه خورده بیشتر آشنا شوید.

مراحل تعمیر آسانسور آسیب دیده

در مرحله اول، متخصصان ابتدا کابین آسانسور را بررسی میکنند و در صورت لزوم آن را از تونل آسانسور خارج می کنند و آن را به کارگاه بازسازی منتقل می نمایند. سپس با استفاده از ابزار های مخصوص تمامی اجزای متصل به کابین را باز می نمایند و اجزای قابل استفاده را نگهداری و دیگر وسایل را دور می ریزند. سپس شاسی آسانسور را به وسیله ابزار های لیزری مورد بررسی قرار می دهند و اگر آسیب سبب تاب دار شدن آن شده بود، شاسی را به طور کامل تعویض می نمایند.

در مرحله دوم تعمیر آسانسور ، متخصصان تمامی اجزای قابل استفاده را با دقت بسیار بالا بر روی کابین نصب می نمایند. پس از آن، بجای قطعات آسیب دیده و کهنه از قطعات نو استفاده می کنند تا بتوانند ایمنی و امنیت کابین را افزایش دهند. پس از تکمیل کابین، آن را به محل مورد نظر منتقل می نمایند. سپس دلیل وارد شدن آسیب و ضربه را شناسایی و مشکل را برطرف می نمایند و کابین را با دقت داخل تونل آسانسور قرار می دهند و اتصالات الکتریکی و مکانیکی را متصل می نمایند. در مرحله آخر، متخصصان سوار آسانسور می شوند و در چندین مرحله آن را بررسی می نمایند و تحویل مشتری می دهند تا ساکنان بتوانند با خیالی آسوده از آسانسور استفاده نمایند و لذت ببرند.

تعویض آسانسور یا تعمیر آسانسور ؟

امروزه متاسفانه قطعات آسانسور با کیفیت بسیار پایین و قیمتی بالا در بازار عرضه می شوند. جالب است بدانید که اگر برای تعمیرات آسانسور قصد خرید کابین نو را داشته باشید، در صورتی که از مشاوره درست در انتخاب شرکت آسانسور استفاده نکنید ، ممکن است پس از مدتی به مشکل برخورد نمایید و مجبور به پرداخت هزینه های تعمیرات مجدد آسانسور خود بشوید. به همین دلیل، بهترین راه با صرفه اقتصادی بالا انتخاب پیمانکار امین و ماهر است و با مشاوره با اول تصمیم بگیرید که کابین آسانسور تعمیر شود یا با کابین نو باکیفیت تعویض شود .

البته تعمیر کابین آسانسور نسبت به تعویض آن دارای هزینه بسیار مناسب تری است ولی در مواردی شما پس از گذشت مدتی مجبور به تعمیر مجدد آن خواهید شد. به همین دلیل، پیشنهاد می شود اگر آسانسور شما بسیار فرسوده شده است، بجای تعمیر قطعات آن ها را تعویض نمایید. در بسیاری از مواقع ممکن است بنا بر دلایلی کابین آسانسور و دیگر اجزا دچار آسیب شدید بشوند. فراموش نکنید که پس از تعمیرات آسانسور، یافتن علت امری الزامی است چرا که اگر مشکل به طور کامل برطرف نگردد، ممکن است پس از مدتی آسانسور شما مجدد دچار مشکل بشود.

تعمیر آسانسور در آپارتمان

تعمیر آسانسور در آپارتمان ها یک نیاز است. نمی توانیم بگوییم تا به حال هیچ آپارتمان یا ساختمانی به تعمیرات آسانسور نیازی نداشته است. به هر حال، قطعات آسانسور در معرض استهلاک و اصطکاک قرار می گیرند و به تعمیرات یا حتی تعویض نیاز پیدا می کنند. اما یک نکته مهم در اینجا وجود دارد که قیمت تعمیرات آسانسور آپارتمان چقدر است، هزینه ها در بین ساکنین طبقات چطور تقسیم می شود و یک شرکت آسانسور چه کمکی در این شرایط خواهد کرد.

چه موقع به تعمیر آسانسور در آپارتمان نیاز داریم؟

در یک کلام، وقتی آسانسور به درستی کار نکند، خراب شود یا خطری برای افراد داخل کابین آسانسور به وجود بیاید، خدمات تعمیرات آسانسور در آپارتمان، ضروری است. آسانسور به دلایل مختلفی دچار عیب می شود. وقتی قطعات فرسوده شوند، ریل ها و کابل ها دچار سایش شوند، سر و صدای آزار دهنده از آسانسور به گوش برسد، یا اختلالاتی در حرکت و توقف آسانسور به وجود بیاید، اینجاست که می گوییم آسانسور خراب شده و نیاز به تعمیرات دارد. سرویس کاران باید به محل آپارتمان اعزام شوند تا عیب یابی به درستی انجام گیرد.

مثلاً وقتی گیربکس آسانسور خراب شده باشد، کابین آسانسور، تکان های شدید را خواهد داشت. این می تواند به مرور زمان، سیم بکسل را نیز تحت تأثیر قرار دهد و خطرناک باشد. تعمیر آسانسور در آپارتمان در این موارد شامل تعویض قطعات فرسوده است. اگر خرابی آسانسور مربوط به موتور و قسمت موتورخانه باشد، موارد بسیار حادتر است و ممکن است هزینه های بیشتری را تحمیل کند. محاسبه قیمت تعمیرات آسانسور در آپارتمان ها بعد از بررسی کامل همه قطعات و قسمت ها توسط بازرسین و شرکت آسانسور انجام می شود. ممکن است در ابتدا یک قیمت پایه برای سرویس معمولی به مشتری اعلام شود، اما در ادامه، اگر آسانسور نیاز به سرویس کامل داشته باشد، قطعاً این هزینه ها بیشتر خواهد شد.

تقسیم بندی هزینه تعمیر آسانسور در آپارتمان ها برای ساکنین

طبق قانون تملک آپارتمان ها، ماده 23، همه ساکنین در همه طبقات در یک آپارتمان موظف به پرداخت هزینه تعمیر آسانسور در آپارتمان هستند و کسی نمی تواند از این قاعده مستثنی باشد. اگر بین ساکنین یک ساختمان بر سر پرداخت هزینه تعمیرات و سرویس آسانسور اختلافی پیش بیاید، با همکاری مدیر ساختمان و مشورت با کارشناسان شرکت آسانسور، این مشکل قابل حل است.

بهترین شرکت برای خدمات تعمیرات آسانسور آپارتمان

نصب آسانسور در آپارتمان، کاری بسیار حساس و دقیق است و باید بهترین تکنسین ها این کارها را انجام دهند. هر شرکت یا فرد که در این عملیات، کوتاهی کند یا استانداردها و قوانین را نادیده بگیرد، صدمات و خسارت های زیادی را به بار خواهد آورد. بسیاری از آسیب ها و خرابی هایی که در آسانسورها به وجود می آید می تواند ناشی از سهل انگاری در فرآیند نصب و راه اندازی باشد.

اگر قرار است خدمات تعمیرات آسانسور در آپارتمان خود را از شرکت آسانسور معتبر دریافت کنید، رعایت قوانین و مقررات، جزئی جدایی ناپذیر خواهد بود. این چنین شرکت ها با تیم حرفه ای می توانند همه کارها را از صفر تا صد، کاملاً دقیق و اصولی انجام دهند. شرکت آسانسور با تهیه نقشه کاملی از ساختمان و بررسی مسیرهای حرکت آسانسور در طبقات، عیب یابی را به راحتی انجام می دهد. فراموش نکنید که خدمات تعمیرات آسانسور را بر طبق عقد قرارداد با شرکت دریافت کنید و چه بهتر که این خدمات به صورت سرویس دهی دوره ای باشد تا از آسیب ها و خرابی های بیشتر جلوگیری نماید.

تعمیر آسانسور اصفهان

تعمیر و نگهداری صحیح آسانسور در اصفهان باعث صرفه جویی در هزینه و تضمین خدمات می شود. تعمیر آسانسور اصفهان و نگهداری حرفه ای معمول همه تجهیزات و قطعات آسانسور برای جلوگیری از مشکلات است؛ قبل از اینکه به تعمیرات پرهزینه یا خطرات ایمنی بزرگ تبدیل شوند. اگرچه قرارداد خدمات تعمیرات ماهانه ممکن است در ابتدا گران به نظر برسد، اما در مقایسه با تعمیرات پرهزینه آسانسور و جریمه های احتمالی نقض قوانین ایمنی به دلیل بی توجهی و کوتاهی، یک هزینه جزئی است. بیایید در ادامه به مهم ترین نکات درباره استفاده از خدمات تعمیر آسانسور اصفهان بپردازیم.

5 ترفند برای خدمات تعمیرات و نگهداری آسانسور

- با مقررات ایمنی آسانسورها همراه باشید

زمانی که آسانسورهای تجاری به درستی نگهداری نشوند و استانداردهای ایمنی در آنها مجاز نباشند، پتانسیل بالایی برای ایجاد موقعیت های خطرناک را دارند. با این حال، رعایت تمام مقررات ایمنی می تواند آسانسور را به یکی از ایمن ترین روش های تردد بین طبقات تبدیل کند. مقررات آسانسور قطعاً به طور مرتب تغییر می کند تا بهترین شیوه ها و فناوری روز را منعکس سازد. برای استفاده از خدمات تعمیرات آسانسور اصفهان، با آخرین و جدیدترین قوانین و دستورالعمل ها هماهنگ باشید. اطلاعات جدید را از بهترین شرکت آسانسور دریافت کنید.

- تجهیزات اضطراری و ارتباطی را بررسی کنید

هدف از تعمیرات و نگهداری آسانسور، جلوگیری از وقوع حوادث ناگوار است. همه آسانسورها دارای یک سیستم پشتیبان، برای استفاده در زمان قطعی برق هستند و همچنین سیستم روشنایی و ارتباطی اضطراری دارند. اطمینان حاصل کنید که این امکانات ایمنی مورد نیاز، در طول بازرسی های ماهانه، بطور مرتب چک میشوند و به درستی کار می کنند. این کار برای به حداقل رساندن توقف های احتمالی آسانسور و جریمه ها، الزامی است. نگران کارهایی که باید در هنگام سرویس یا تعمیر آسانسور اصفهان انجام شود، نباشید؛ تکنسین های ما همه کارها را برایتان ردیف می کنند تا تجهیزاتی ایمن داشته باشید.

- نسبت به تعمیرات نگهداری آسانسور، مسئول باشید

هر چه نسبت به استفاده از خدمات سرویس، تعمیرات - نگهداری آسانسور ساختمان خود مسئول تر باشید، بیشتر از بروز مشکلات جلوگیری میکنید. هنگام تعمیر و نگهداری ماهانه آسانسور و بازرسی آن ، بهترین زمان برای بررسی مشکلات است، به خصوص در ساختمان های تجاری که آسانسور، بارهای سنگین را با ترافیک بسیار بالا روزانه حمل می کنند. بسیاری از خطرات ذاتی ممکن است در تجهیزات آسانسور، آشکار نباشند، بنابراین بسیار مهم است که یک تکنسین مجاز، آسانسور شما را در یک برنامه منظم بازرسی کند؛ این کار به طور قطع، از تعمیرات پرهزینه در آینده جلوگیری خواهد کرد.

- اتاقک و چاهک آسانسور را تمیز نگه دارید

اتاقک ماشین آسانسور و چاهک تجهیزات پایه، هر دو مناطق اصلی هستند که باید تمیز نگه داشته شوند. طبق مقررات، فقط تجهیزات مربوط به آسانسور باید در اتاقک ماشین قرار بگیرند. برای جلوگیری از جریمه ها و خطرات احتمالی، اشیای دیگری را در اتاقک ماشین آسانسور یا چاهک نگهداری نکنید. تجمع رطوبت یا نشت روغن در چاله آسانسور می تواند به تجهیزات آسانسور آسیب زیادی وارد کند، پس نیاز به تعمیرات پرهزینه خواهد داشت. اگر آب در چاهک آسانسورتان وجود داشته باشد، باید مراقب نشتی باشید و بعد از برطرف کردن آن چاهک را کاملا خشک کنید و اطمینان حاصل کنید مجدد نشتی آب بوجود نیاید.

- یک برنامه منظم برای خدمات تعمیر آسانسور اصفهان تنظیم کنید

بازرسی های پیشگیرانه آسانسور و برنامه تعمیر و نگهداری مداوم، ایمنی آسانسور شما را افزایش می دهد و هزینه های کلی آن را کاهش خواهد داد. بدون یک برنامه زمانبندی شده خاص، تعمیر آسانسور اصفهان و حتی بازرسیها میتواند نامنظم شود و به طور بالقوه، فاصلههای زیادی بین چکآپها ایجاد کند که منجر به تعمیرات و نوسازی پرهزینه میشود. استفاده از یک شرکت خدمات آسانسور به شما کمک می کند تا بازرسی های مورد نیازتان و نگهداری های منظم را انجام دهید. با این کار، در مسیر نگه داشتن آسانسورها در بهترین شکل ممکن قدم بر می دارید.

تعمیر آسانسور صنعتی

شرکت ها و سازندگان، تکنسین ها و متخصصان، موارد مرتبط با ایمنی آسانسورها را بسیار جدی می گیرند و لذا به خدمات بازرسی و تعمیر آسانسور صنعتی بسیار اهمیت می دهند. این تجهیزات جزو مهمترین بالابرها در صنایع کوچک و بزرگ محسوب می شوند و حمل و نقل بار را به لحاظ مکانیکی بسیار آسان تر می سازند. مالکان آسانسور صنعتی باید یک برنامه منظم روزانه و دوره ای برای تعمیرات – نگهداری آسانسور خود داشته باشند. این اقدامات برای حفظ استانداردهای ایمنی بسیار مهم است و به افزایش طول عمر آسانسور، قطعات و کاهش زمان فرسودگی همه قسمت های آن کمک می کند.

اگر در کسب و کار صنعتی خود یکی از انواع بالابرها و آسانسورها را دارید، سعی کنید با مقررات و قوانین ملی سازمان استاندارد آسانسور، هماهنگ باشید. این مقررات همواره در حال به روزرسانی هستند تا این صنعت را بهبود ببخشند. برخی قوانین سختگیرانه برای انواع آسانسور صنعتی و تجاری وجود دارد تا ایمنی بیشتری فرآهم شود.

خدمات بازرسی و یا تعمیر آسانسور صنعتی برای همه قسمت های این تجهیزات ارائه می شود. طبق قوانین، در حین بازرسی، تکنسین ها همه دیواره ها، پانل های کف و سقف و دکمه های آسانسور را از نظر استحکام و دوام بررسی می کنند. منطقه چاهک آسانسور یا قسمتی که موتورخانه قرار دارد، به خوبی بازرسی می شود تا از سالم بودن عملکرد همه قطعات و اجزا اطمینان حاصل شود. اگر کارشناسان و ناظران متوجه کوچک ترین عیب و نقص در آسانسور صنعتی شوند، در اولین فرصت، دستور تعمیرات صادر خواهد شد.

چطور هزینه های تعمیر آسانسور صنعتی را کاهش دهیم؟

یکی از اهداف مهم تعمیرات آسانسور صنعتی، ارائه یک سیستم کارآمد و ایمن به مدیر تأسیسات است. به این ترتیب، خدمات آسانسور و تأمین ایمنی افراد و بار قابل حمل باید در اولویت باشد. پس برای اینکه به این هدف برسید باید بازرسی منظم را برای آنها انجام بدهید. این کار دقیقاً همان اقداماتی است که هزینه های تعمیر آسانسور صنعتی را به شدت کاهش دهند.

به طور متداول، بهتر است بازرسی آسانسور صنعتی، هر ماه یک بار انجام شود. این کار حتماً باید توسط تکنسین های شرکت معتبر آسانسور انجام گیرد. ما به عنوان یک شرکت مجرب که سال هاست در این زمینه فعالیت می کنیم، توصیه داریم که برای بازرسی و تعمیرات – نگهداری آسانسورهای صنعتی هرگز تأخیر نداشته باشید و این کارها را هر ماه، یک بار انجام بدهید. اینکه شما ماهانه تمامی قسمت های آسانسور را چک کنید، بهتر از آن است که پس از یک مدت، به دلیل کوتاهی کردن، هزینه های هنگفت برای تعویض قطعات آسیب دیده بپردازید.

نکات مهم در خدمات تعمیر آسانسور صنعتی

قدمت سیستم آسانسور صنعتی و اندازه ساختمان، هر دو فاکتورهایی هستند که باید هنگام برنامه ریزی تعمیرات و نگهداری در نظر گرفته شوند، زیرا آسانسورهای قدیمی با تجهیزات بیشتر، ممکن است به خدمات دقیق تری نیاز داشته باشند که زمان بیشتری را می طلبد. همچنین، میزان استفاده از آسانسور ممکن است به این معنی باشد که سیستم، سریع تر در معرض فرسودگی قرار می گیرد، بنابراین باید در مورد میزان استفاده از آسانسور، با شرکت ارائه دهنده خدمات صحبت شود. مهم است که یک مدیر تأسیسات صنعتی بتواند به ارائه دهنده خدمات آسانسور اعتماد کند. برای این کار می توانید همین حالا با کارشناسان ما تماس بگیرید. هر سوالی درباره خدمات بازرسی دوره ای و سرویس آسانسور صنعتی دارید، کارشناسان ما پاسخگوی شما عزیزان هستند.

تعمیر خرابی آسانسور

اگر شما مسئول ساختمانی هستید که تجهیزات آسانسور دارد، اطلاع از نحوه عملکرد و مشخصات فنی سیستم آسانسور می تواند به شما کمک کند تا به راحتی مشکلات ایجاد شده را شناسایی کنید. این یعنی در وقت و هزینه شما صرفه جویی خواهد شد. دانستن اطلاعات زیر می تواند به همه دارندگان آسانسورها کمک کند تا ایمنی بیشتری را فرآهم سازند.

5 نکته مهم در مورد نگهداری و تعمیر خرابی آسانسور

1. زمان مناسب برای سرویس تجهیزات آسانسور چه موقع است؟

یکی از مهم ترین نکات برای شناسایی و تعمیر خرابی آسانسور، اطلاع از زمان مناسب انجام بازرسی ها است. آسانسورهایی که به طور معمول بازرسی و نگهداری نمی شوند، با خطر خرابی بیشتری مواجه هستند. سرویس آسانسور، یک بار در ماه، به حفظ ایمنی آنها کمک می کند و همچنین می تواند طول عمر آنها را افزایش دهد.

2. نگهداری پیشگیرانه، چقدر ضروری است؟

ممکن است تعویض قطعات کوچک یا فرسوده و خراب در آسانسور، کمی غیر ضروری به نظر برسد، اما انجام این کار می تواند شما را از آسیب های شدیدتر در طولانی مدت نجات دهد. تعمیرات یا تعویض قطعات کوچک در شرایط کار، می تواند عمر طولانی تری به سیستم شما بدهد. با تعویض قطعات فرسوده زودتر موعد خرابی آنها از توقف بی موقع ، چه بسا در ایام تعطیل سال ، پیشگیری میشود .

3.بهترین زمان برای به روزرسانی سیستم آسانسور چه موقع است؟

برای استفاده از خدمات تعمیر خرابی آسانسور، باید به مهم ترین نشانه ها دقت کنید. این علائم نشان می دهند که آسانسور شما چقدر قدیمی یا فرسوده شده است و برخی قطعات، احتمالاً باید جایگزین شود. تجهیزات قدیمی تر با اتفاقات زیر روبرو هستند:

- بیشتر خراب می شوند

- پیدا کردن قطعات جایگزین، دشوارتر است.

- باعث آزار و کاهش ایمنی افراد می شود.

- ممکن در زمان تعطیلات طولانی سال تامین قطعات معیوب ممکن نباشد.

هنگامی که متوجه شدید این مشکلات به طور مکرر رخ می دهد، از یک تکنسین با تجربه در مورد به روز رسانی آسانسور خود کمک بگیرید.

4. چگونه یک تکنسین حرفه ای را برای تعمیر خرابی آسانسور پیدا کنید؟

از آنجایی که استفاده از آسانسورها بسیار مهم است، بهتر است تکنسین هایی را انتخاب کنید که به آنها اعتماد دارید. از بهترین شرکت های خدمات آسانسور کمک بگیرید تا از هر نظر مطمئن باشند.باید شرکت هایی را انتخاب کنید که مجوزهای لازم را از اتحادیه کشوری آسانسور و پله برقی ، سندیکای آسانسور و پله برقی ایران و پروانهدطراحی و مونتاژ از وزارت صمت را دارا باشند.

5. هزینه خدمات تعمیرات آسانسور چقدر است؟

در حالی که قیمت خدمات تعمیرات آسانسور متفاوت خواهد بود، مزایایی که به دست می آورید، بسیار بیشتر از هزینه ها است. قیمت تعمیر خرابی آسانسور با توجه به مدل آسانسور، نوع مشکل یا نیاز به خرید قطعات جدید و ... تعریف می شود. می توانید این قیمت ها را از شرکت ما جویا شوید.

مهم ترین مشکلات آسانسور را بشناسیم!

عیب یابی آسانسور بسیار مهم است. در قسمت زیر متداول ترین مشکلاتی را مشاهده می کنید که برای انواع آسانسور ممکن است رخ بدهد؛ سعی کنید در هر مورد، از بهترین شرکت خدمات تعمیر خرابی آسانسور با تکنسین های مجرب کمک بگیرید:

- توقف ناگهانی آسانسور هنگام حرکت در بین طبقات

- برگشت یا ضربه زدن در شروع حرکت

- کاهش چشمگیر زمان بالا رفتن آسانسور

- اختلال در شتاب حرکت آسانسور

- توقف در هر طبقه با سرعت زیاد

- بالا و پایین ایستادن مکرر کابین با تراز سطح طبقات

- ضربه زدن هنگام توقف کابین آسانسور

- بر هم خوردن توقف آسانسور در طبقات مورد نظر

- شنیدن سرو صدای اضافی و غیر معمول داخل کابین یا موتورخانه آسانسور

- بالارفتن مصرف برق آسانسور نسبت به قبض برق های قبلی

البته موارد فوق، فقط مهم ترین مشکلات خرابی آسانسورها هستند. اگر هر علائم دیگری مشاهده کردید، بی درنگ با شرکت خدمات آسانسور تماس بگیرید.

تعمیر فوری آسانسور

رایج ترین مشکلات آسانسور چیست؟

- قطعی برق آسانسور

- فلکه کشش اصلی فرسوده موتور آسانسور

- آلودگی ها در سیستم آسانسور

- خرابی بلبرینگ ها

- نصب نامناسب موتور یا عدم شاقول بودن موتور

ضرورت تعمیر فوری آسانسور

اگر در سرویس آسانسور، کوتاهی کنیم، چه اتفاقی می افتد؟

قیمت تعمیر فوری آسانسور چقدر است؟

چه ابزارها و تجهیزاتی برای تعمیر آسانسور لازم است؟

- چراغ قوه: برای بررسی دقیق قطعات خارج از کابین آسانسور، به چراغ قوه احتیاج خواهید داشت.

- ابزارهای ایمنی: امنیت تعمیرکار در زمان تعمیر اهمیت دارد. در همین راستا، تجهیزاتی مانند؛ دستکش، کلاه ایمنی ، کمربند ایمنی برای کار در ارتفاع و سایر تجهیزات ایمنی ضروری است.

- ابزارهای برقی دستی: از این ابزارها مثل دریل و پیچ گوشتی برقی برای نصب آسانسور و تجهیزات حفاظتی استفاده می شود. همچنین در تنظیم تجهیزات پس از نصب نیز نقش دارند.

- تجهیزات کنترل و عیب یابی: در تعمیر آسانسور ریشه یابی مشکل نقشی اساسی دارد. تجهیزات عیب یابی مانند؛ آمپرمترهای کلمپی ، و مولتی متر به پیدا کردن دلیل خرابی برقی آسانسور کمک می کنند.

- ابزارهای دستی: ابزارهای دستی پایه و اساس هر تعمیری هستند. بدون شک برای رفع مشکل خرابی آسانسور به ابزارهای مانند: انواع آچار تخت و بکس، انبرقفلی و آچار شلاقی نیاز خواهید داشت. به موارد قبل می توان پیچ گوشتی، متر، سوهان و کمان اره را نیز اضافه کرد.

چه راه هایی برای کاهش هزینه تعمیر آسانسور وجود دارد؟

تعمیر و نگهداری آسانسور یکی از مسائلی است که می تواند، هزینه های زیادی به شما تحمیل کند. راه های مختلفی برای کاهش هزینه های نگهداری و تعمیر آسانسور وجود دارد که در ادامه به بررسی آن ها می پردازیم:

- انجام بررسی های منظم: تشخیص قطعات فرسوده قبل از بروز مشکل، تا حد زیادی به صرفه جویی در هزینه های تعمیر کمک می کند. اگر قطعات خراب قبل از بروز مشکل تعویض شوند نیاز به تعمیرات پرهزینه در آینده، از بین می رود.

- ارتباط با کارشناسان قابل اعتماد: تشخیص به موقع و ریشه یابی صحیح مشکل، در تعمیر آسانسور اهمیت بالایی دارد. اگر خرابی آسانسور به درستی پیدا و حل نشود هزینه های اضافی در پی خواهد داشت. به همین دلیل ارتباط با کارشناسان ماهر و قابل اعتماد آسانسور ضروری است

- ریشه یابی مشکل: به جای تعمیر خرابی های سطحی، به رفع مشکل اصلی بپردازید. ریشه خرابی را پیدا کنید و آن را از بین ببرید تا از هزینه های بعدی جلوگیری شود.

- تمیز نگه داشتن آسانسور و موتورخانه: آلودگی و گرد و غبار می تواند به بخش های متحرک آسانسور آسیب برساند. علاوه بر این، وجود رطوبت و نشتی در موتورخانه می تواند تجهیزات اساسی را دچار مشکل کند. به همین دلیل، تمیز نگه داشتن آسانسور و موتورخانه در کاهش هزینه های تعمیر تاثیرگذار است.

چه نکاتی را باید در هنگام استفاده از آسانسور رعایت کنیم؟

رعایت نکات ایمنی در زمان استفاده از آسانسور اهمیت خیلی زیادی دارد. تعمیر آسانسور به صورت دوره ای می تواند اطمینان خاطر خوبی به افراد ساکن در مجتمع بدهد. یکی از نکات مهم قبل از ورود به آسانسور این است که دکمه آسانسور را فقط یک بار فشار بدهید. برخی افراد چندین بار و با فشار بیشتر دکمه ورودی آسانسور را می فشارند تا آسانسور زودتر بیاید؛ اما این کار اشتباه است. آسانسور طبق طبقات و به صورت منظم به سمت طبقه شما می آید و فشار دادن بیشتر دکمه فقط باعث خرابی آن می شود. توجه کنید در صورت تکمیل بودن ظرفیت آسانسور سوار نشوید؛ زیرا مشکل فنی در آسانسور به وجود آمده و خطرات زیادی دارد. درون هر آسانسور ظرفیت و وزن مناسب نوشته شده است که حتما باید به آن توجه داشته باشید.

بهترین محل برای ایستادن در آسانسور کجاست؟ بهترین محل دور از درب های آسانسور و سمت دیواره های آن است. سعی کنید دست خود را به میله عقب آسانسور گرفته یا به دیواره ها تکیه دهید. در زمان حوادثی مثل آتش سوزی در ساختمان بهترین کار رفتن از پله ها است؛ زیرا آسانسور با مشکلات برق روبرو خواهد شد. در زمان سوار شدن توجه کنید که سطح داخلی آسانسور کجا قرار گرفته تا باعث زمین خوردن شما نشود. بعد از ورود به آسانسور دکمه طبقه مقصد را زده و مانع بسته شدن درب نشوید. توجه داشته باشید که آسانسورهای مسافری برای جابه جایی بار مناسب نیستند و وسایل سنگین را با آسانسور مسافری جابه جا نکنید. برخی افراد برای جلوگیری از بسته شدن درب آسانسور از موانع مختلف استفاده می کنند که این کار روی عملکرد درست آسانسور تاثیر منفی دارد. با رعایت نکات درست، می توانید به راحتی از آسانسور استفاده کنید.

چه عواملی باعث افزایش عمر و کارایی آسانسور میشوند؟

پیشگیری از خرابی آسانسور در افزایش طول عمر و عملکرد این تجهیز مؤثر است. برای اینکه آسانسور شما ایمن و موثر کار کند، باید از طول عمر آن آگاه باشید و اقدامات لازم را جهت سرویس، بازسازی و تعمیر آسانسور انجام دهید. راهکارهای زیر می تواند در افزایش طول عمر و کارایی آسانسور موثر باشد. با به کار بستن این راهکارها می توانید عمر مفید آسانسور خود را افزایش دهید.

- اجرای تست های ایمنی

تست های ایمنی باید به صورت دوره ای برای اطمینان از عملکرد صحیح آسانسور انجام شوند. این تست ها باید توسط افراد متخصص در این حوزه انجام شود.

- کنترل محیط

محیط قرارگیری آسانسور تأثیر بسیار زیادی در عملکرد آن دارد. گرد و خاک زیاد یا افزایش دمای بیش از حد محیط، می تواند باعث بروز مشکلات برقی شده و به سیستم های کنترل آسانسور، آسیب وارد نماید.

- عدم تحمیل فشار به آسانسور

هر آسانسوری برای ظرفیت مخصوصی طراحی و تولید شده است و به هیچ عنوان نباید بیش از این ظرفیت، از آسانسور استفاده شود. علاوه بر این نباید از آسانسور مسافربری به عنوان آسانسور باربری استفاده کنید.

- تعویض و تعمیر قطعات فرسوده

تعمیر آسانسور به صورت دوره ای شامل تعویض قطعات فرسوده نیز می شود. بسیاری از قطعات به مرور زمان دچار ساییدگی می شوند و باید به موقع تعویض شوند. تعویض نکردن آن ها می تواند منجر به خرابی سایر قسمت ها شده و آسانسور را از کار بیندازد.

.gif)

.gif)

ارسال نظر

نکته: HTML ترجمه نمی شود!